Stock Futures Trade With Cautiously Higher. Crypto Traders Experience A Visit from Santa

US and European stock futures are trading cautiously higher as traders are preparing themselves for the final week of trading before many of them break off for a holiday period. Many traders are hoping for a Santa rally this week on the back of an important event that will take place towards the back end of this week. However, the fear is that the event may not bring an optimistic message for them given the latest economic readings that we have seen for the US economy.

The main focus among traders and investors for this week is the Fed meeting and its decision on the monetary policy. There are hopes that the Fed will still cut the interest rates despite the fact that we have seen less favourable reading for the US CPI data—an important mandate for the Fed—and they have been in a war with inflation throughout this year, and it certainly seems that the battle isn’t over yet. The fact that the US CPI reading has started to move in the less favourable direction, traders believe that the Fed will actually deliver a somewhat hawkish message this week, and even if they cut the interest rate on a daily basis, they will be very much so doing this with a hawkish message.

So, the baseline for the market expectation for the Fed meeting, which takes place on Thursday, is that the Fed will fire the bullet from their gun—lower the interest rate; however, the move will be very much so a hawkish one as they would make it clear that their policy is not on autopilot and they can pause the cycle of cutting the interest rates if the data continues to print numbers that deliver unfavourable conditions.

Speaking of unfavourable, UK traders are getting themselves ready for an event where there will be nothing more than disappointment for them, and that event is the Bank of England’s interest rate decision. Given the latest data and fresh upcoming UK CPI number, the base case for us is that the Bank of England is not going to Santa to deliver good news during this time. The expectation is that there will be a hold on the process of cutting the interest rates.

Cryptos

There is no shortage of good news in the crypto world, and it seems that bitcoin traders are going to continue to get more presents from Santa in terms of higher highs for the bitcoin price. There was a time when 100K was a real profit-taking target for most traders and investors, but with new momentum, many traders think and believe that they need to adjust their expectations, and the new realistic target for them is bitcoin’s price hitting the level of 150K at minimum and with 200K a real potential by the end of this next year at this time. This means that traders are going to hold their horses and wait patiently while celebrating every single victory as the bitcoin price makes new highs.

Gold Prices

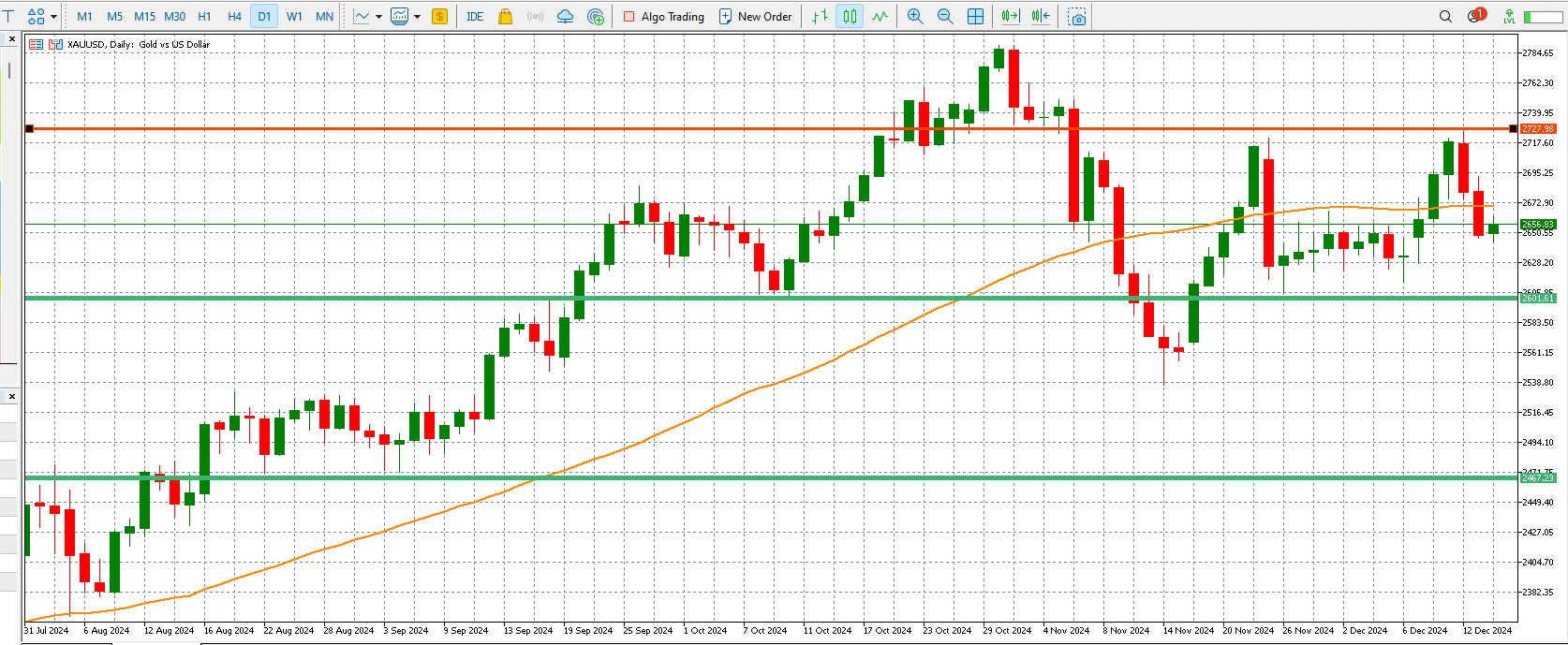

The shining metal is likely to see a bit more retracement this week with the Fed meeting in focus. The fact that there is not much hope for another interest rate and traders are expecting that the Fed may deliver a more hawkish message in their speech means that the gold traders are likely to see more retracement in terms of the price action. This simply means that the gold price could continue its grind towards the downside as the risk-on rally may become more favourable for traders to achieve a bigger bang for their bucks.

The below chart shows important price levels for gold price action

Gold chart from online MT4 trading platform from Avatrade