Oracle Stock Doubles in a Year. Will the Rally in ORCL Last?

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

Oracle (ORCL) stock has been on a tear, more than doubling in a year. This includes over 70% growth in its share price in the last three months. This stellar rally in ORCL stock is led by solid momentum in its business, especially cloud, and an expected acceleration in its growth rate in fiscal 2026.

The technology company wrapped its fiscal 2025 with a strong fourth quarter, delivering double-digit revenue growth. This performance strengthened investors’ optimism, especially as Oracle’s management signaled that the company’s growth rate is likely to accelerate in the coming quarters. With expectations of an even faster pace of revenue growth in fiscal 2026, the company is laying the groundwork for sustained stock gains.

The Catalyst Behind ORCL Stock

A major driver behind Oracle’s surge is the explosive growth in its cloud services. Revenues from cloud services and license support were notably strong in the fourth quarter, and demand for its cloud infrastructure, Oracle Cloud Infrastructure (OCI), continues to skyrocket. OCI’s non-cancelable bookings suggest potential revenue growth of over 70% in the coming fiscal year, a figure that points to long-term scalability and strength in Oracle’s cloud offerings.

The company’s evolution into a cloud-first enterprise software leader is playing a central role in its growth story. Oracle is becoming a go-to technology partner for businesses undergoing digital transformation, offering a full suite of cloud-based applications that help streamline operations. Oracle’s recent integration of more than 100 AI agents into these platforms adds a layer of automation and intelligence, potentially accelerating adoption across industries that require innovative and efficient solutions.

Artificial intelligence is another key pillar in Oracle’s expansion strategy. Through its Autonomous Database and AI-powered data platform, Oracle is offering enterprise clients the kind of performance, flexibility, and cross-cloud compatibility that are essential in today's AI-driven landscape. Crucially, Oracle’s infrastructure is designed to integrate across major cloud providers—including AWS, Azure, and Google Cloud — making it a compelling option in a multi-cloud world.

In short, as businesses double down on digital transformation and AI integration, Oracle appears well-positioned to benefit.

Oracle’s Outlook Suggests Accelerated Growth in Fiscal 2026

Oracle expects to generate over $67 billion in revenue in fiscal 2026, up 16% from the previous year. That compares to an 8% increase in fiscal 2025, reflecting the expected acceleration. The company also holds a hefty $138 billion in remaining performance obligations (RPO), with a rapidly expanding cloud backlog, which will support future growth.

Cloud revenue as a whole, including applications and infrastructure, is expected to grow 40% in fiscal 2026, up from 24% last year. Moreover, the momentum in Oracle’s MultiCloud database business is likely to sustain. This business is already showing impressive gains with revenue soaring 115% sequentially in Q4. Oracle is expanding its MultiCloud data centers aggressively, with 47 new locations planned on top of the 23 already in operation. Further, management sees the segment delivering triple-digit growth in fiscal 2026.

Another rapidly growing component is Cloud@Customer, Oracle’s hybrid cloud model that brings its infrastructure directly into clients’ on-site data centers. Revenue from this offering grew 104% year-over-year in Q4, with the company planning to double its current footprint by adding 30 new centers in fiscal 2026.

Meanwhile, usage-based OCI consumption revenue rose 62% in the latest quarter and is poised to keep climbing as Oracle’s cloud footprint expands and adoption deepens across sectors.

The Bottom Line

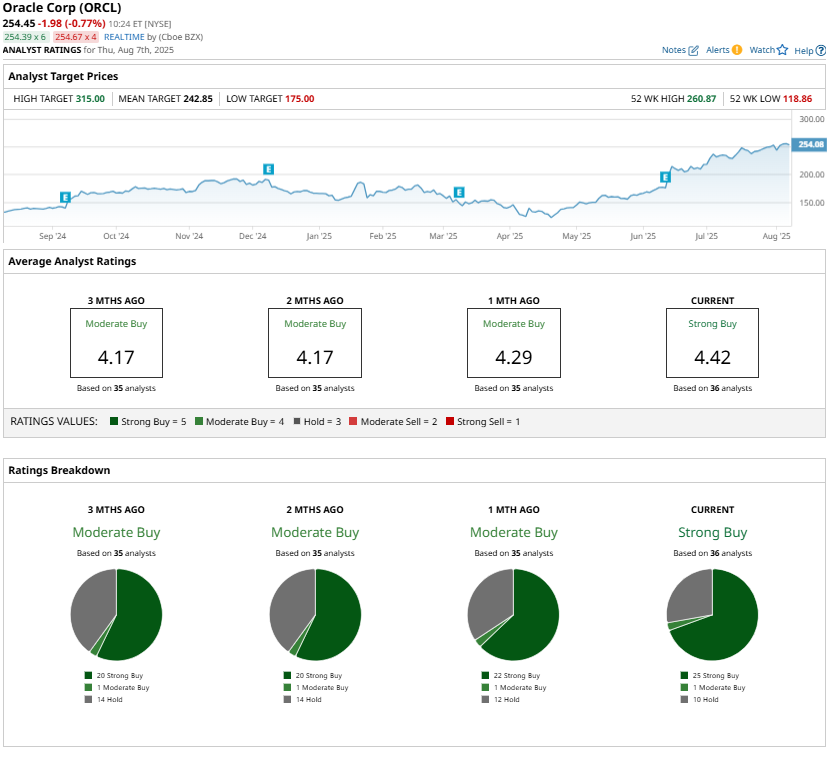

Despite the strong run-up, Wall Street continues to favor Oracle, maintaining a “Strong Buy” consensus rating.

The Street's highest price target on Oracle stock is $315, which implies further upside potential from current levles. Moreover, with Oracle’s fast-growing cloud operations, expanding AI integration, and solid multi-cloud strategy, the stock could climb even higher.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.