Why This Outperforming Gold Stock Could Keep Climbing, According to Wall Street

Gold is stealing the spotlight once again. Amid escalating geopolitical tensions, President Donald Trump’s tariff hammer, potential rate cuts, and central banks' aggressive stockpiling of gold, investor appetite for the precious metal is heating up. December-dated gold futures (GCZ25) — the most actively traded contract — climbed above the $3,500 mark on July 23 before trimming back some of those gains. One company riding the recent gold wave? Kinross Gold (KGC).

The Canadian gold mining company has been outperforming the broader market in 2025. Shares of KGC have returned a staggering 106% so far this year, dwarfing the broader S&P 500 Index ($SPX), which has gained 8% over the same period.

In fact, analysts believe KGC stock can continue to climb, with UBS analysts initiating coverage on the stock with a bullish “Buy” rating and a price target of $20. Analysts at UBS also believe gold prices will remain elevated at $3,500 per ounce in 2026, and growing cash returns will cause further re-rating for the company.

About Kinross Gold Stock

Founded in 1993 and headquartered in Toronto, Canada, Kinross Gold is a leading gold mining company. The company enjoys a global presence with mining and exploration activities in countries such as the U.S., Brazil, Chile, and Mauritania.

Kinross produces gold and silver through its open-pit and underground mining methods, while maintaining a strong emphasis on efficiency, sustainability, and responsible mining practices. The company's major assets include the Fort Knox, Paracatu, La Coipa, and Tasiast projects. Kinross has a market capitalization of $22.8 billion.

Gold prices have been on the rise lately. As evidence, the iShares Gold Trust (IAU) has gained 29% so far this year. On Aug. 5, spot gold prices rose for a fourth-straight session. This is the result of economic data indicating a potential interest rate cut in September. Additionally, tariffs imposed by the Trump administration are likely to remain in place, which boosts gold’s appeal as a “safe haven” asset.

KGC stock has also been rewarding investors for quite some time. Over the past 52 weeks, the stock has gained 127%. Shares reached a 52-week high of $19.05 on Aug. 7.

Despite the robust performance in its stock price, Kinross Gold is still trading at an attractive valuation. Its price sits at 13.6 times forward earnings, which is lower than the current industry average.

Kinross Gold Reported Robust Q2 Results

On July 30, Kinross Gold reported solid results for the second quarter of fiscal 2025. The company produced 512,574 attributable gold equivalent ounces and sold 508,300 gold equivalent ounces. While these figures were lower than those of the prior-year period, the average attributable realized gold price per ounce climbed from $2,342 to $3,285.

As a result, Kinross Gold’s metal sales jumped by 42% year-over-year (YOY) to $1.73 billion. Its operating earnings stood at $774.8 million, up 160% YOY. Kinross Gold’s adjusted net earnings per share stood at $0.44, which was higher by 214% annually and surpassed the $0.33 that Wall Street analysts were expecting.

Additionally, since Kinross restarted its share buyback program in April, the company has purchased shares worth $225 million out of the $500 million planned for the year. The company is currently undertaking multiple development projects, including the Great Bear project in Ontario and the Round Mountain Phase X project in Nevada.

Wall Street analysts are extremely optimistic about Kinross Gold’s future earnings. They expect the company’s EPS to increase by 20.8% YOY to $0.29 for the third quarter of 2025, followed by a 45% growth to $0.29 in the fourth quarter as well. For the current fiscal year, EPS is projected to surge 103% annually to $1.38.

What Do Analysts Think About Kinross Gold Stock?

Apart from the UBS coverage initiation, Wall Street analysts are currently significantly bullish on this gold miner. Recently, CIBC analyst Anita Soni raised the price target from $21 to $22, maintaining an “Outperformer” rating. CIBC analysts have reiterated their bullish price targets for Kinross Gold, reflecting optimism about the company’s future.

In June, Jefferies upgraded KGC stock from “Hold” to “Buy,” while raising the price target from $14 to $18. Jefferies sees opportunity for Kinross Gold to increase share repurchases based on its projected free cash flow yield. Analysts also noted the company’s trajectory toward achieving 2 million ounces of gold production by 2026 as a reason for the upgrade.

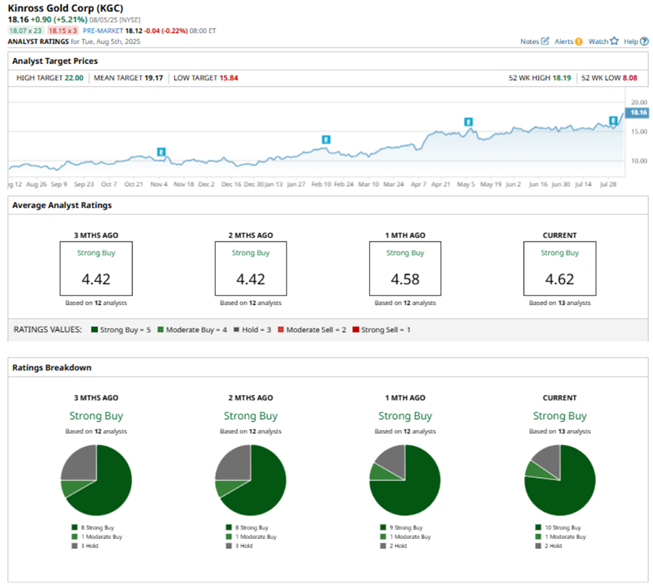

Kinross Gold maintains a favorable position on Wall Street, with analysts giving it a consensus “Strong Buy” rating overall. Of the 13 analysts rating the stock, a majority of 10 analysts rate it a “Strong Buy.” In contrast, one analyst suggests a “Moderate Buy,” and two analysts take a middle-of-the-road approach with a “Hold” rating.

The consensus price target of $19.17 represents minimal upside from current levels. However, the Street-high price target of $22 indicates 15% potential upside. As gold prices remain elevated, Kinross Gold may continue to experience upward adjustments in its price target, potentially leading to increased shareholder returns.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.