Nio’s L90 Sales Are Soaring: Is It Time to Buy NIO Stock Now?

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

Nio (NIO) investors are bound to be an unhappy lot as the stock has closed in the red for four consecutive years and trades at a fraction of its 2021 highs. Nio was once seen as a promising Chinese electric vehicle (EV) startup company, with some dubbing it the “Tesla of China.”

The company, however, failed to meet those expectations, and the price action is a testament to its weak operating and financial performance. While Chinese rivals, particularly Xpeng Motors (XPEV), raced ahead in monthly deliveries, NIO’s monthly deliveries have failed to move decisively higher.

Nio’s New Models Failed to Lift Sales

To spur deliveries, Nio came up with several new models, including in sub-brands Onvo and Firefly, which are budget vehicles priced below the eponymous brand, which the company has positioned as a premium EV brand. However, these new models did not help drive the expected increase in Nio’s sales, even as Xpeng Motors managed to achieve scale with its Mona M03.

Onvo was particularly a disappointment, and Nio admitted that its sales were below expectations. However, the recent launch of the L90 SUV under the Onvo brand could change the scenario, as reports suggest that the model has received a strong response and is proverbially flying off the shelves.

L90 Is Priced Quite Competitively

Nio has priced the L90 quite competitively at under $37,000 in domestic currency, which is below the pre-launch price. The car’s price falls to just around $25,000 if the buyer opts for battery-as-a-service (BAAS) instead of buying the battery with the car. Nio’s battery swap service helps it lower the initial buying price of the car, and the buyer can then buy the battery on a subscription.

Just three days after the launch, the L90 has made it into the top 3 in large SUVs in China based on insurance data, and reports suggest that Nio is pushing to deliver over 10,000 of these in August. For context, ES6 and Onvo L60 are the only two other models from Nio that achieved a monthly sales volume in five figures. L90 has received positive reviews, especially for the value for money it brings to the table, as it offers premium features at an affordable price.

That said, it remains to be seen whether the L90 sustains its initial sales momentum, as it's not uncommon for models to see strong demand at launch. Moreover, given the model’s aggressive price, I would look for color on the margins that Nio expects to make on the model.

Nio Stock Forecast

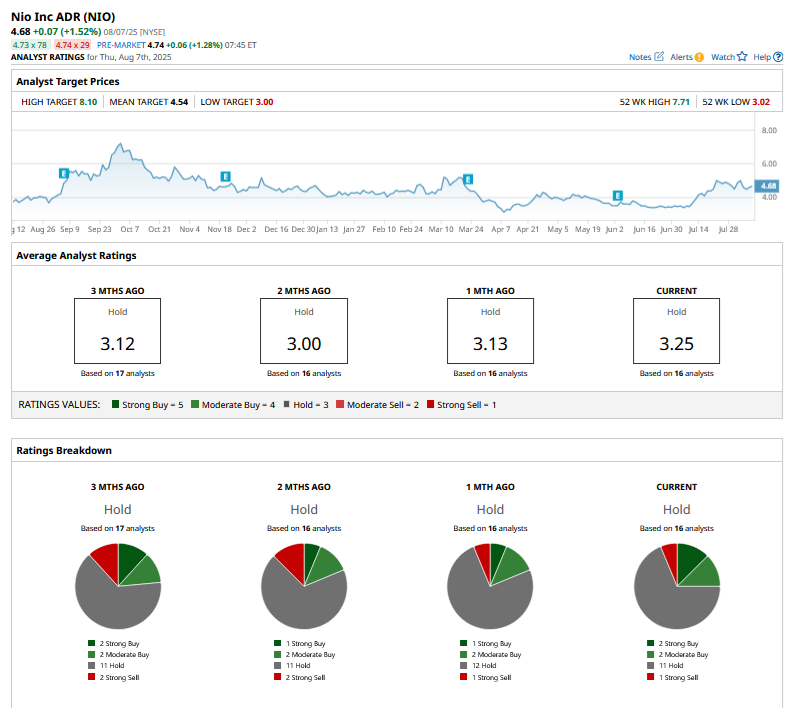

Nio has been out of favor with sell-side analysts for quite some time now, even as Goldman Sachs upgraded it to a “Neutral” from “Sell” in June after the stock's YTD underperformance. Of the 16 analysts covering the stock, two rate it as a “Strong Buy,” while two as a “Moderate Buy.” Eleven analysts rate Nio as a “hold,” while one analyst has rated the stock as a “Strong Sell.” Amid the rally from its 2025 lows, Nio has run ahead of its mean target price of $4.54, but the Street-high target price of $8.10 is 73% higher than the Aug. 7 closing price.

Should You Buy Nio Stock?

Nio stock trades at a forward price-sales multiple of 0.79x, which is below Xpeng Motors and Li Auto (LI). However, both these companies have executed much better than Nio and also have higher margins. Nio has been a case of false starts, and while some of its previous models showed promise, the company failed to achieve scale with them.

For Nio stock to rise from these levels, the company would need to reach a higher plateau in terms of monthly deliveries while improving its margins. The company has set an ambitious goal of reaching breakeven in the final quarter of this year, and the L90 would be a key moving part if it is to hit that goal.

Overall, given the initial positive response to L90, I would stay put in Nio for now. However, I see it as a make-or-break moment for the company and would consider exiting the stock if the L90 momentum fizzles away, as some of the previous models have.

On the date of publication, Mohit Oberoi had a position in: NVDA , LI , XPEV . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.