What Game Is Being Played in Grains Early Monday Morning?

The Grains sector started the overnight session quietly in the red, before the US president did what the US president tends to do: Say something.

Gold was hit hard through Monday's early morning hours, losing as much as $82.50 (2.4%).

November soybeans rallied as mucha s 27.5 cents (2.8%) early Monday, giving us a good clue as to why.

Morning Summary: The New York Times runs a daily word game called Wordle. The object of the game is to guess the computer generated 5-letter word, that changes each day, within 6 tries. The game lets you know 1) If the word you’ve guessed is correct 2) If you have the right letter(s) 3) and if the letter(s) is in the correct place. One of the rules is the word won’t be person or place, ruling out one 5-letter word[i] in particular for the puzzle I put together for today’s illustration[ii]. What brought a daily word game to mind starting the week? When last I checked Sunday night, the commodity complex was under light pressure. When I fired the quote scree back up pre-dawn this morning I found gold had fallen by as much as $82.50 (2.4%) while November soybeans – yes, soybeans – had rallied as much as 27.5 cents (2.8%). Naturally, my next step was to look up some key word, starting with the big one: China. Here, headlines focused on chip-makers Nvidia and AMD, so I continued. Next was “Tariff” (or Taxes, for the 5-letter word folks), and finally “Beans”. It was my last guess when the puzzle revealed itself.

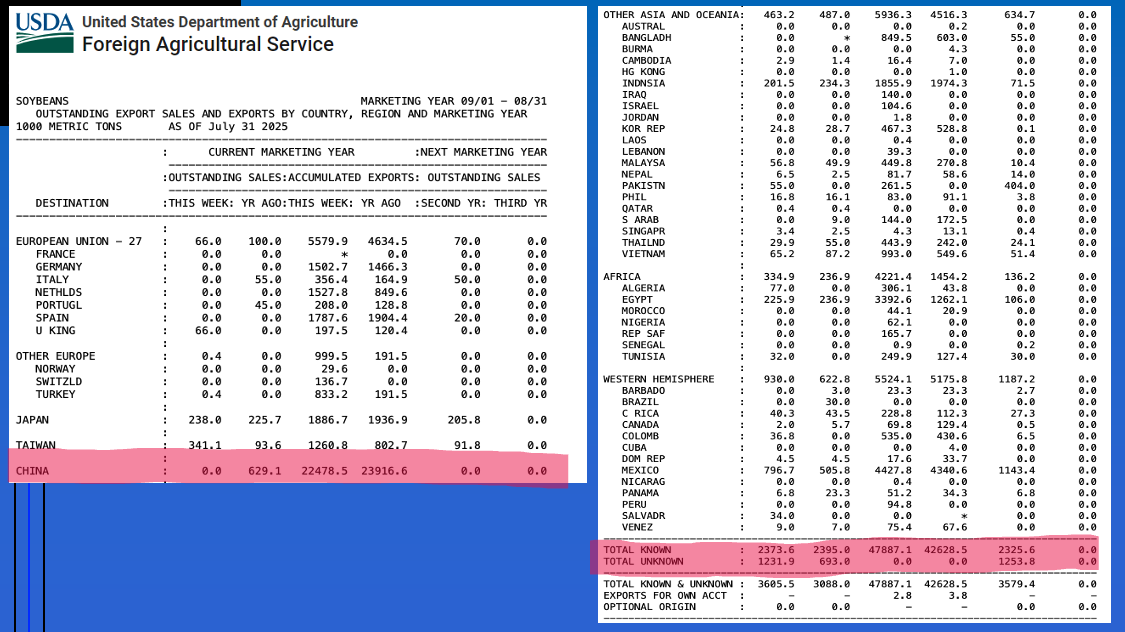

Soybeans: Given this, I’ve shifted the batting order of Monday’s Morning Commentary, move Sir Soybeans into the leadoff spot in place of King Corn. Once I had searched the word “Soybeans”, the page was filled with headlines telling me, “(The US president)[iii] ‘urges’ China to Quadruple US Soy Buying”[iv]. This was enough to rally the November issue (ZSX25) 30 cents from its overnight low on solid trade volume of 62,500 contracts. A couple things jumped out at me immediately, both leading to the same conclusion: The intelligence part of the “Artificial Intelligence” driving most algorithm trade is lacking. Here’s why: The US president always says things like this, has always said things like this, and it means absolutely nothing. Does anyone remember the much-ballyhooed Phase 1 deal? Anyone? Bueller? China is also known for taking a long-term approach to war of any type[v], and it is this same US president who created a social-media driven trade war back in 2018. The other part that made me laugh was the idea the US president urged China to “quadruple” its buying of US supplies. As of July 31, China officially had zero US supplies on the books. And if I remember my math correctly, anything times “0” is still “0”.

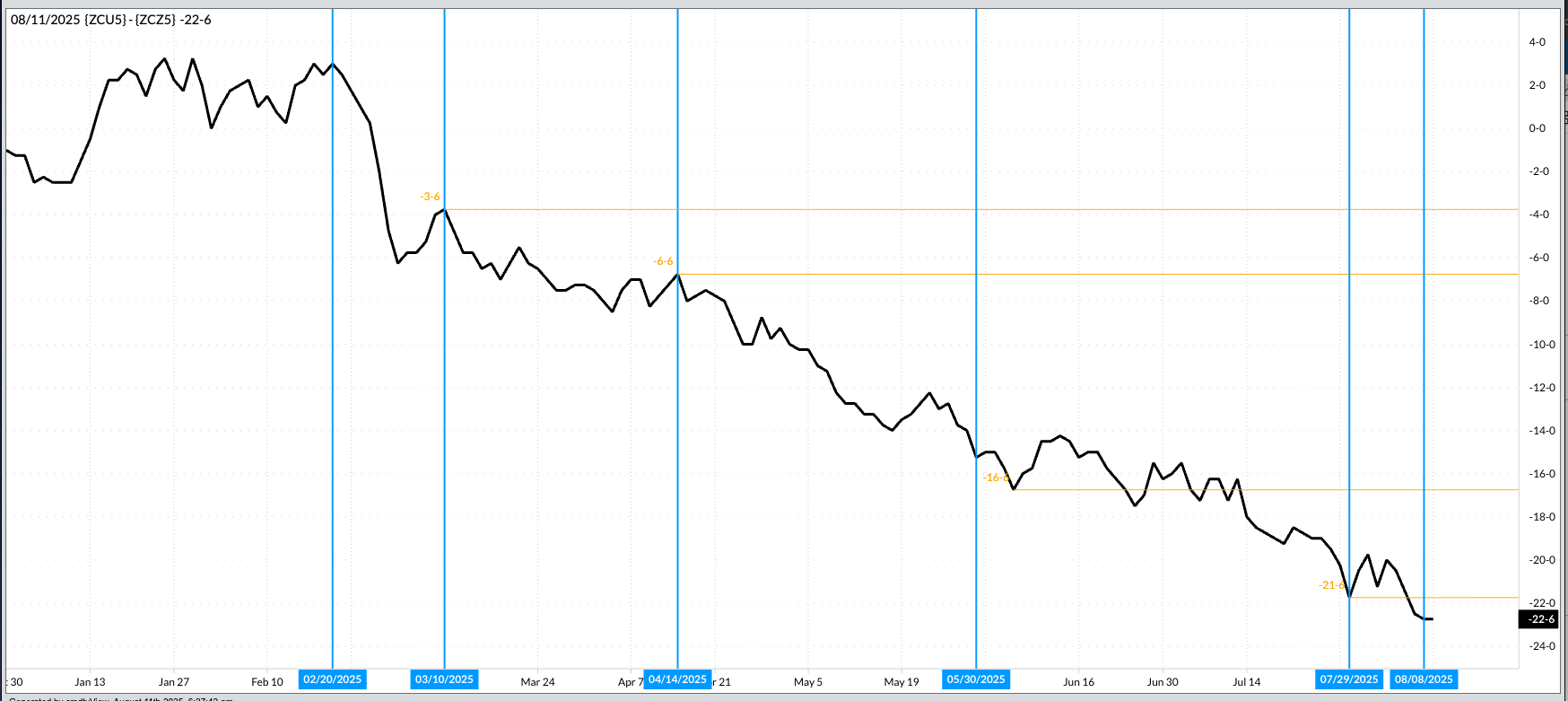

Corn: The corn market followed soybeans higher overnight through early Monday morning. While trade volume picked up a bit due to the spike in soybean activity, it would still be considered moderate at best coming out of a late summer weekend. The more active December issue (ZCZ25) posted a trading range of 5.75 cents, from down 2.5 cents to up 3.25 cents on trade volume of 30,500 contracts and was sitting 2.5 cents higher at this writing. Fundamentally, I didn’t see anything to get excited about as I did Weekly Analysis over the weekend. The National Corn Index ($CNCI) was priced near $3.6525 Friday evening, what would be its lost end of August figure since 2020’s $3.2650 but near the previous 5-year average monthly close for August of $3.6850. National average basis came in at 17.5 cents under September and 40.25 cents under December, both weaker than the previous Friday’s final figures. Lastly, the September-December futures spread closed last Friday at 22.75 cents carry and covered 75% calculated full commercial carry with the Dec-March was covering 57%. The most bullish factor is likely Watson continued to hold a net-short futures position of 108,000 contracts as of Tuesday, August 5, this itself a decrease of 25,500 contracts from the previous week.

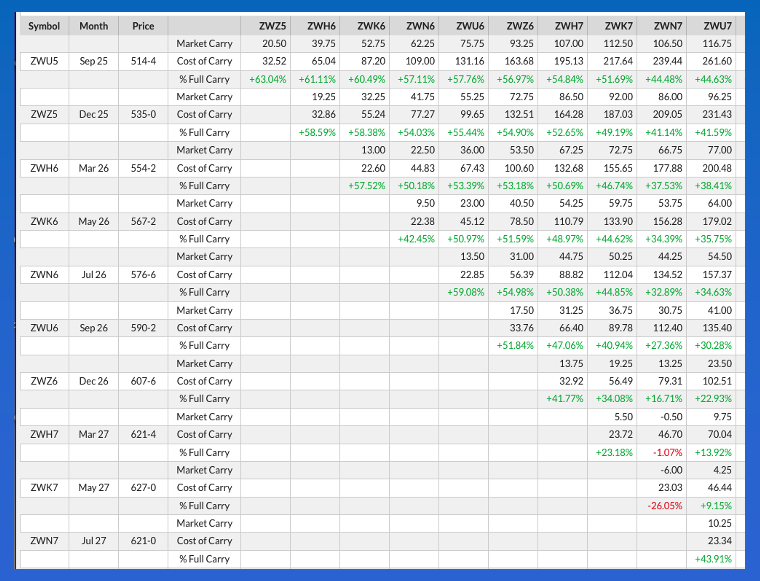

Wheat: The wheat sub-sector also saw a little spillover buying from soybeans through Monday’s pre-dawn hours. The more heavily traded SRW market saw its September issue (ZWU25) initially slip as much as 1.25 cents before rallying as much as 6.25 cents on trade volume of 9,700 contracts as of this writing. It was a similar story for December issue as it also dropped as much as 1.25 cents before rallying as much as 5.75 cents while registering 5,100 contracts changing hands. Last Friday’s latest Commitments of Traders report showed Watson held a net-short futures position of 78,600 contracts, an increase of 8,900 contracts from the previous week, so a little noncommercial short-covering to start the week isn’t a complete surprise. Fundamentally the market grew more bearish last week as futures spreads covered move calculated full commercial carry while national average basis weakened. Additionally, the National SRW Index ($CSWI) came in near $4.5750, what would be its lowest August monthly close since 2019’s $4.4025 with the previous 5-year average end of August price at $4.6525. As for HRW, the September issue rallied as much as 2.25 cents but found itself back in the red as of this writing[vi] on trade volume of 4,100 contracts. December had also dipped lower pre-dawn

[i] Yes, I know, the particular word is both a name and a verb.

[ii] In case you play Wordle, yes, I used today’s puzzle but no, I tried not to give much away. If you want to use my letters as hints, more power to you.

[iii] Insert 5-letter name/verb here if you like.

[iv] From Bloomberg

[v] As then Minnesota Congressman Colin Peterson said at a meeting I had the opportunity to attend, long-term to China is hundreds of years. Long-term to the US is 15 minutes. Or something to that effect.

[vi] As I was writing the Wheat Segment to be specific.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.