What Are Wall Street Analysts' Target Price for American Tower Stock?

With a market cap of $96.7 billion, American Tower Corporation (AMT) is one of the world’s largest global REITs, specializing in owning, operating, and developing multitenant communications real estate. With a portfolio of over 149,000 communications sites and a growing network of U.S. data center facilities, it provides infrastructure solutions that support wireless connectivity worldwide.

Shares of the Boston, Massachusetts-based company have lagged behind the broader market over the past 52 weeks. AMT stock has dropped 7.7% over this time frame, while the broader S&P 500 Index ($SPX) has increased 20.1%. Moreover, shares of American Tower are up 12.6% on a YTD basis, compared to SPX’s 8.6% rise.

Zooming in further, the wireless infrastructure provider stock’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) marginal decline over the past 52 weeks.

Shares of American Tower fell 4.2% on Jul. 29 after the company slightly lowered its 2025 organic tenant billings growth outlook for the U.S. and Canada to about 4.3% and cut its leasing forecast by roughly $5 million. Management also reduced its 2025 net income forecast to $2.3 billion - $2.4 billion, citing weaker foreign currency impacts. Additionally, Q2 2025 net income dropped 58.1% year-over-year to $381 million, pressuring investor sentiment despite stronger-than-expected quarterly revenue of $2.6 billion.

For the fiscal year ending in December 2025, analysts expect American Tower’s AFFO per share to decline 3.1% year-over-year to $10.21. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

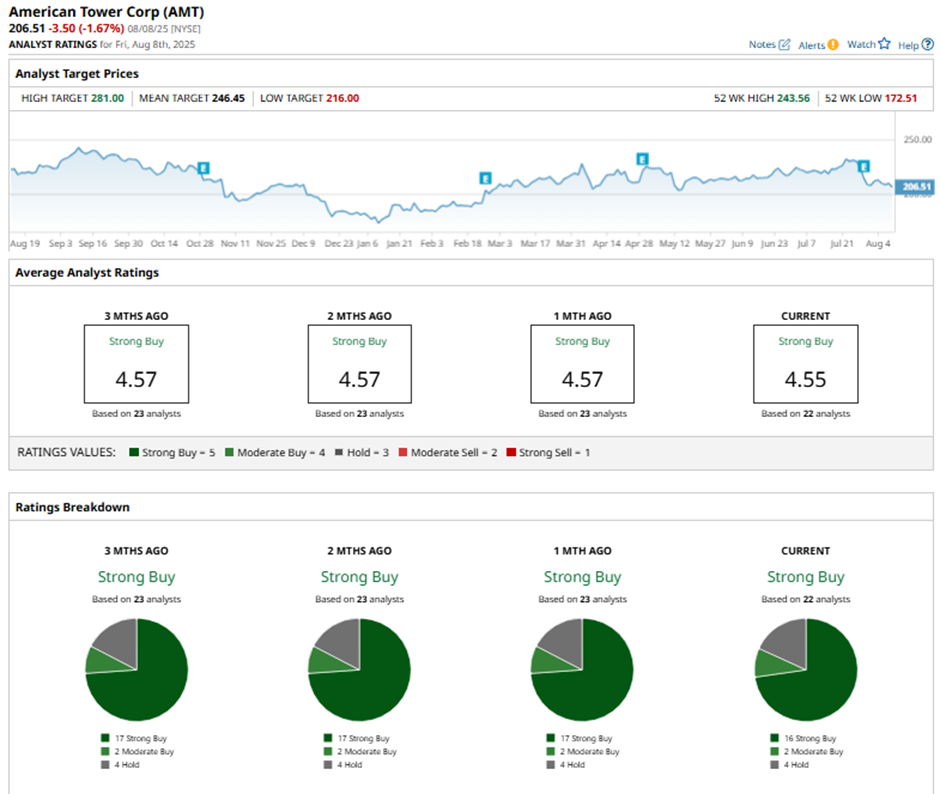

Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

This configuration is slightly less bullish than three months ago, with 17 “Strong Buy” ratings on the stock.

On Jul. 30, BMO Capital’s Ari Klein cut American Tower’s price target to $245 but maintained an “Outperform” rating, citing mixed results with strong international, data center, and services performance, and noting that a 50% year-over-year rise in U.S. carrier applications and near-record services revenues.

As of writing, the stock is trading below the mean price target of $246.45. The Street-high price target of $281 implies a potential upside of 36.1% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.