Is Wall Street Bullish or Bearish on Carrier Global Stock?

/Carrier%20Global%20Corp%20location%20sign-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $56.2 billion, Carrier Global Corporation (CARR) is a leading global provider of innovative heating, ventilation, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies. Headquartered in Florida, the company offers a broad portfolio of products, services, and digital solutions designed to enhance energy efficiency, safety, and sustainability in residential, commercial, and industrial applications worldwide.

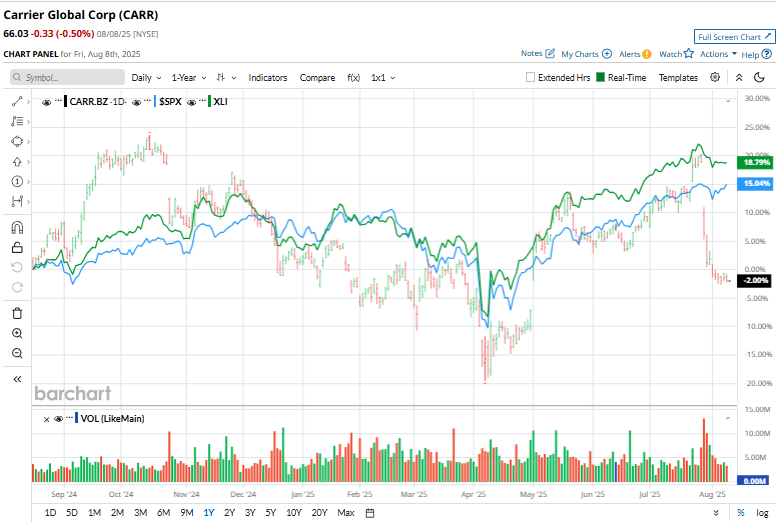

Shares of the company have struggled to keep up with the broader market over the past 52 weeks, rising 2.4%, while the broader S&P 500 Index ($SPX) has rallied 20.1%. Additionally, shares of Carrier Global are down 3.3% on a YTD basis, compared to the SPX’s 8.6% rise.

Focusing more closely, Carrier Global has also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 21.4% return over the past 52 weeks and 14.5% rise in 2025.

On Jul. 29, Carrier Global posted its Q2 2025 earnings, and its shares tumbled 10.6%. It delivered $6.11 billion in net sales, reflecting a 3% increase year-over-year and 6% organic growth. Its adjusted EPS rose 26% to $0.92, and adjusted operating margin climbed 130 basis points to 19.1%. The company generated $649 million in operating cash flow and $568 million in free cash flow,

For the fiscal year ending in December 2025, analysts expect CARR’s EPS to grow nearly 18.4% year-over-year to $3.03. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

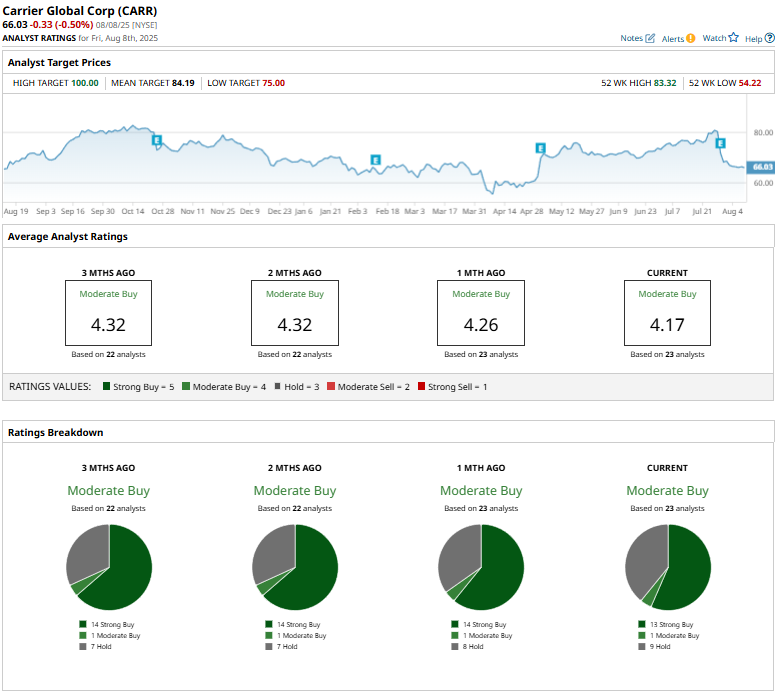

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and nine “Holds.”

This configuration is more bearish than a month ago, with 14 “Strong Buy” ratings on the stock.

On Aug. 8, Morgan Stanley (MS) analyst Chris Snyder maintained an “Equal-Weight” rating on Carrier Global but lowered the price target from $78 to $75.

The mean price target of $84.19 implies a premium of 27.5% from CARR’s current price levels. Also, the Street-high target of $100 indicates a potential upside of 51.4% from the prevailing market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.