D.R. Horton Stock: Is Wall Street Bullish or Bearish?

/D_R_%20Horton%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Arlington, Texas-based D.R. Horton, Inc. (DHI) is the largest U.S. homebuilder by volume, operating in 36 states with brands spanning entry-level to luxury homes. It also offers mortgage, title, and insurance services. Valued at A market cap of $46.7 billion, D.R. Horton operates in the East, North, Southeast, South Central, Southwest, and Northwest regions of the United States.

DHI stock has slumped 9.4% over the past 52 weeks but has performed well in 2025, rising 11.9%. In contrast, the S&P 500 Index ($SPX) has surged 20.1% gains over the past year and 8.6% in 2025.

Narrowing the focus, D.R. Horton has also underperformed the industry-focused SPDR S&P Homebuilders ETF’s (XHB) marginal rise over the past 52 weeks but has surpassed the ETF’s 3.5% return on a YTD basis.

D.R. Horton shares jumped over 5% on Aug. 1 as homebuilding stocks rallied on a drop in the 10-year Treasury yield to a one-month low, boosting housing demand prospects.

For the current FY25, ending in September, analysts expect DHI to deliver an EPS of $11.79, down 17.8% year over year. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates twice over the past four quarters, it missed the projections on two other occasions.

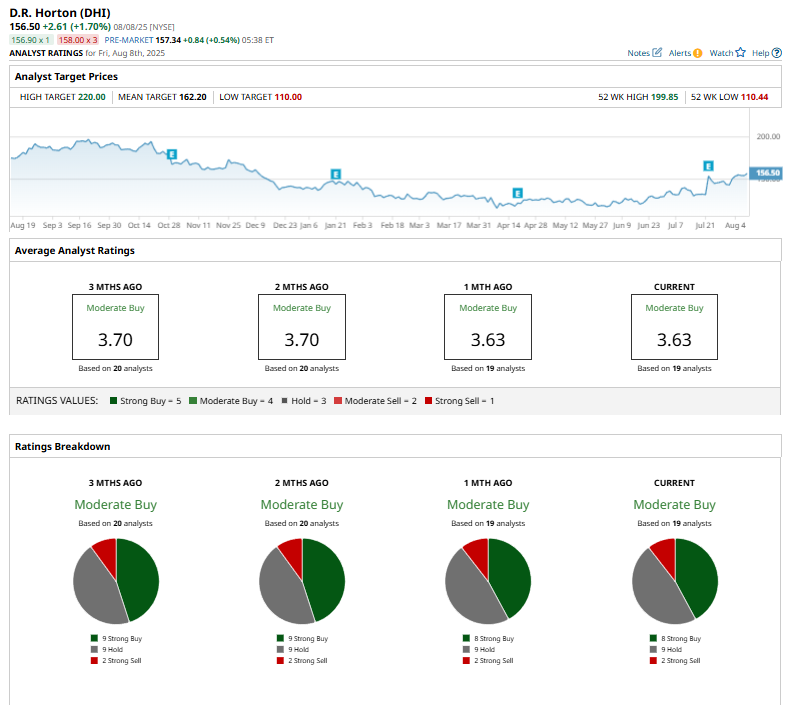

DHI holds a consensus “Moderate Buy” rating overall. Of the 19 analysts covering the stock, opinions include eight “Strong Buys,” nine “Holds,” and two “Strong Sells.”

This configuration is slightly more bearish than two months ago, when nine analysts gave “Strong Buy” recommendations.

On July 24, Keefe, Bruyette & Woods’ Jade Rahmani reiterated a “Market Perform” rating on D.R. Horton and raised the price target from $135 to $161.

D.R. Horton’s mean price target of $162.20 represents a 3.6% premium to current price levels. While its street-high target of $220 suggests a staggering 40.6% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.