Find Oversold Stocks to Buy at a Discount With This Barchart Screener

The stock market is at all-time highs, and many traders are chasing momentum stocks that have already run far ahead. But the best opportunities often come from the other side of the market — buying quality stocks that have temporarily dipped into oversold territory.

In this guide, we’ll break down a simple, step-by-step method to find oversold stocks using Barchart’s powerful stock screener, so you can spot discounts instead of buying at the peak.

Why Look for Oversold Stocks?

Oversold stocks — identified by technical indicators like the Relative Strength Index (RSI) — can signal potential buying opportunities. RSI measures recent price momentum on a scale from 0 to 100. Readings below 30 often indicate a stock is oversold, meaning selling pressure may be overextended and a bounce could be coming.

Instead of reacting to fear of missing out (FOMO) when markets are hitting new highs, targeting oversold setups helps you:

- Avoid chasing inflated prices

- Find better entry points for high-quality companies

- Position ahead of a potential rebound

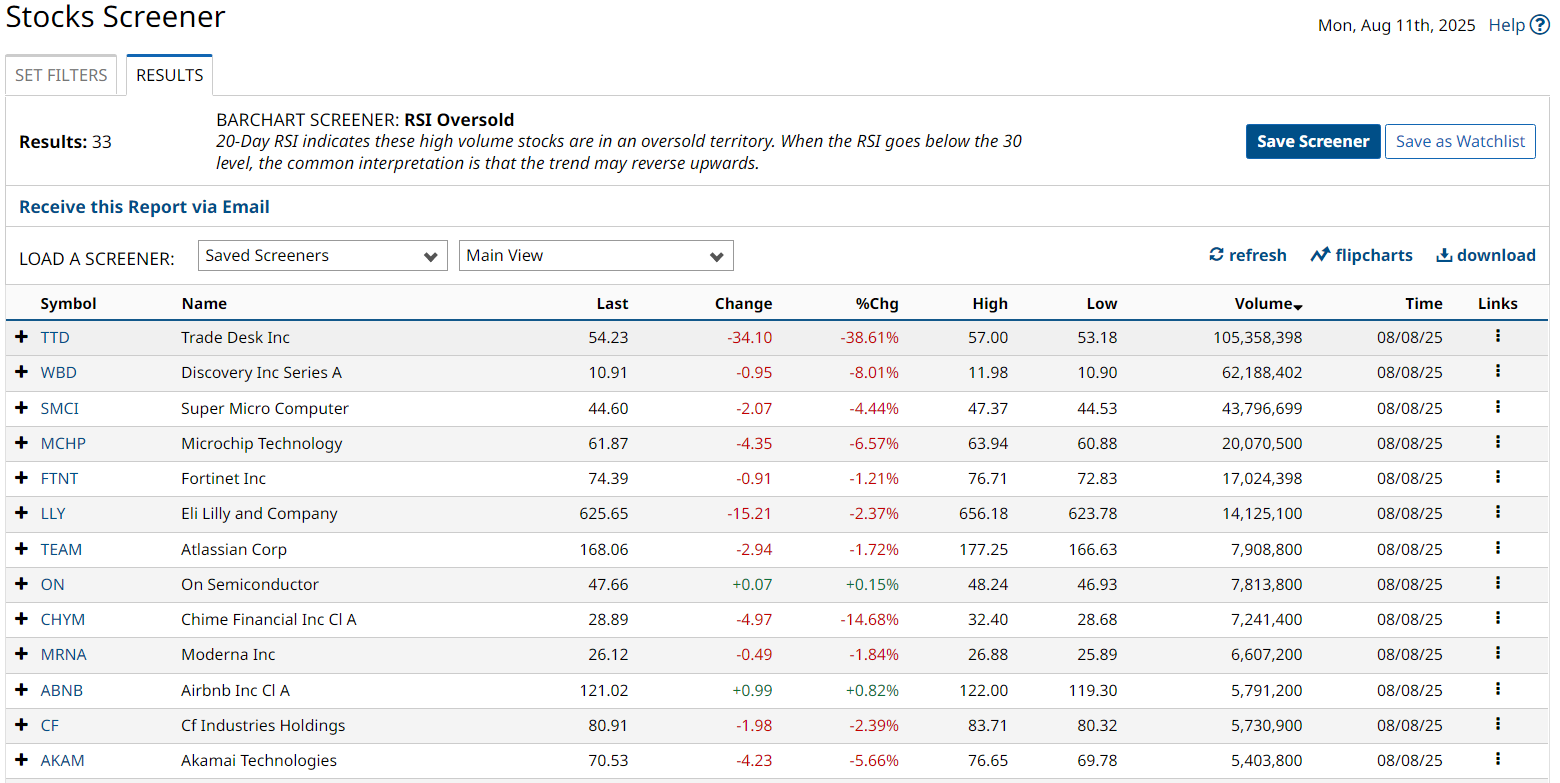

Step 1: Start with the RSI Oversold Pre-Made Screener

Go to Barchart’s Stock Screener.

- Select the pre-made screener RSI Oversold (this will filter for stocks with RSI below 30).

- Sort the list by Volume to highlight the most actively traded oversold names.

This instantly gives you a short list of potential rebound candidates.

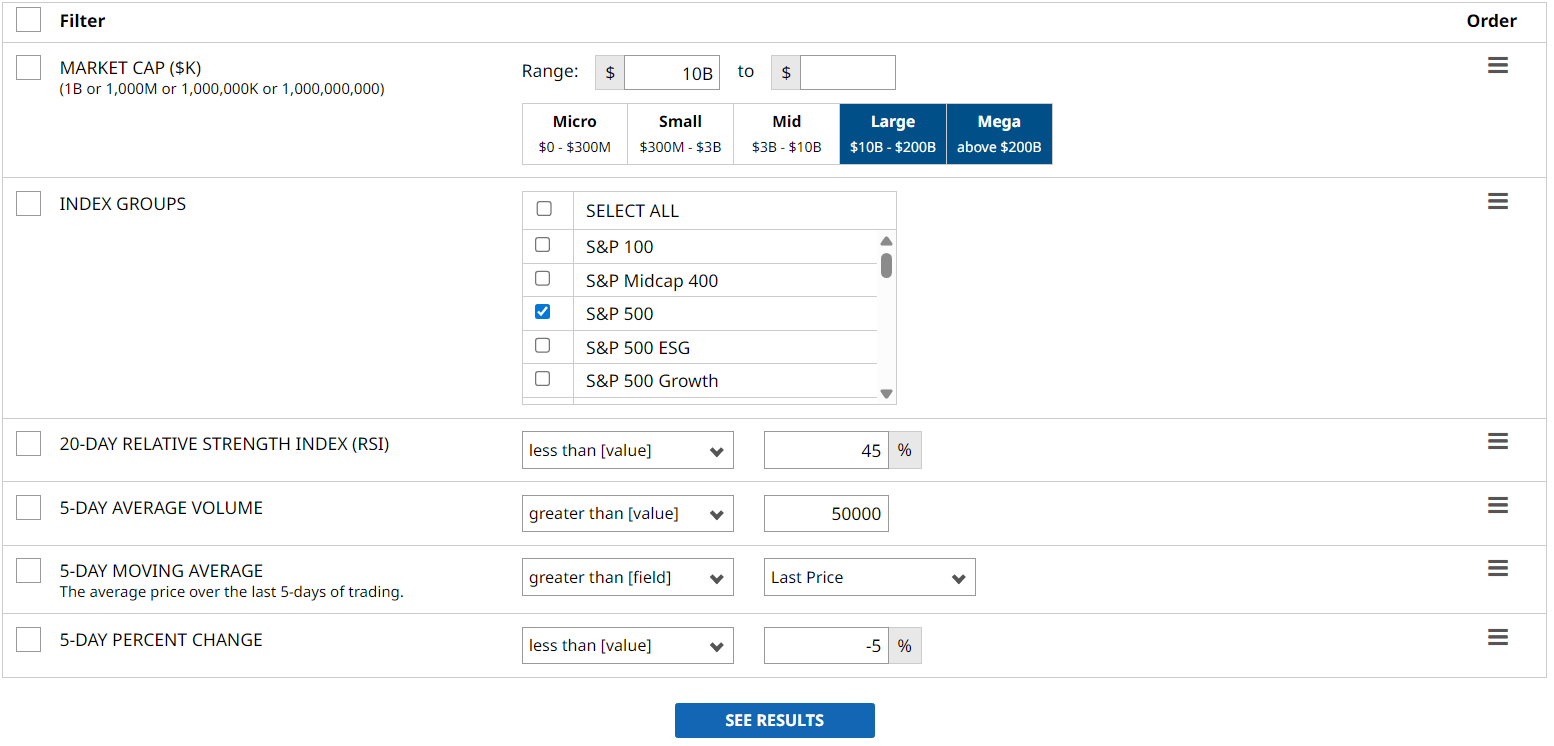

Step 2: Build a Custom Oversold Screener for S&P 500 Stocks

If you want to refine your search, customize the screener to target large, well-known companies:

- Set “Sectors & Index Group” to S&P 500.

- Filter for Market Cap = Large and Mega Cap stocks.

- Adjust the RSI filter to Below 45 to capture both oversold stocks and those recovering from oversold conditions.

With these settings, you might find names like Super Micro Computer (SMCI), Eli Lilly (LLY), Moderna (MRNA), Docusign (DOCU), Trade Desk (TTD), and many more.

Step 3: Analyze and Save Your Results

Once you have your list:

- Use Mini Charts or FlipCharts on Barchart to quickly scan the setups.

- Save the Screener so you can run it anytime in the future.

- Add the results to a Watchlist to monitor price action over time.

Step 4: Keep Exploring with Barchart Tools

Beyond oversold stocks, Barchart offers screeners for ETFs, options, and other asset classes, giving you endless ways to find opportunities in the market.

By using screeners and filtering for oversold conditions, you’ll avoid buying the hype and instead focus on setups where the odds of a bounce are in your favor.

Watch the reel to see this process in action, and start building your own watchlist today:

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.