Are Wall Street Analysts Predicting Abbott Laboratories Stock Will Climb or Sink?

/Abbott%20Laboratories%20vials%20and%20Logo-by%20Melniov%20Dmitriy%20via%20Shutterstock.jpg)

With a market cap of $233.7 billion, Abbott Laboratories (ABT) is a leading global healthcare company engaged in the discovery, development, manufacturing, and sale of a broad portfolio of medical products. The North Chicago, Illinois-based company’s operations span four key segments: diagnostics, medical devices, nutrition, and branded generic pharmaceuticals.

Over the past year, ABT shares have soared 22.3%, surpassing the broader S&P 500 Index ($SPX), which has gained 20.1%. Moreover, ABT stock has risen 18.7% on a YTD basis, compared to SPX's 8.6% rise.

Looking closer, Abbott has also outpaced the Health Care Select Sector SPDR Fund's (XLV) 12.8% decrease over the past 52 weeks and 5.4% dip in 2025.

On Jul. 17, Abbott announced its second-quarter earnings, and its shares dipped 8.5% before rising 2.6% in the next trading session. It posted revenue of $11.14 billion, up 7.4% year-over-year, and adjusted EPS of $1.26, slightly above expectations. Growth in the quarter was led by strong sales of Medical Devices, particularly in diabetes care and cardiovascular products, while Nutrition and Established Pharmaceuticals also saw gains. However, Diagnostics segment declined due to lower COVID-19 testing demand. Additionally, shares fell as the company narrowed its full-year guidance for sales and earnings.

For the fiscal year ending in December 2025, analysts expect ABT’s EPS to grow 10.3% year-over-year to $5.15. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

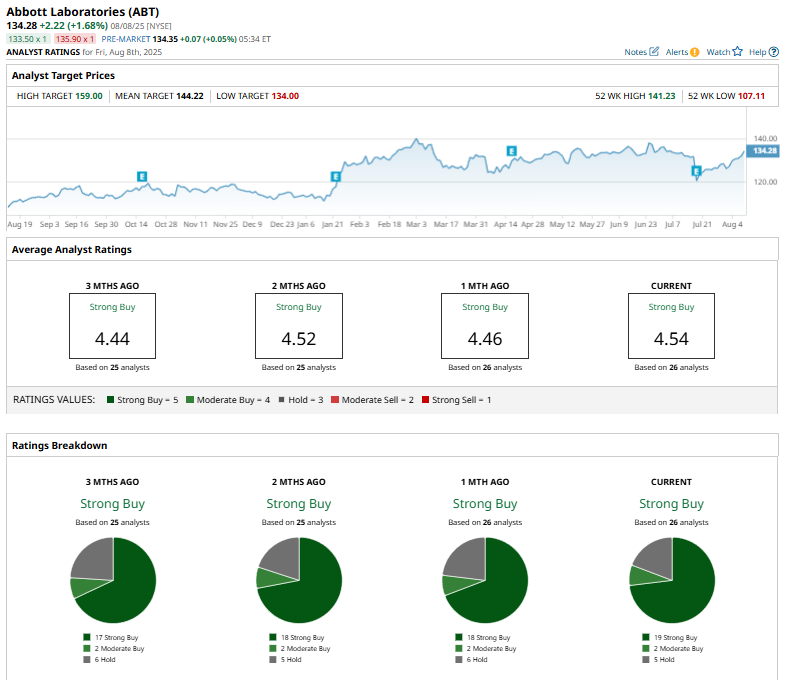

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

The current configuration is more bullish than a month ago, when 18 analysts advised a “Strong Buy” for the stock.

On July 18, Raymond James’ Jayson Bedford reiterated an “Outperform” rating on Abbott Laboratories but trimmed the price target from $142 to $141.

The mean price target of $144.22 implies a premium of 7.4% from the current price levels. The Street-high price target of $159 indicates a modest potential upside of 18.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.