Advanced Micro Devices Stock: Is Wall Street Bullish or Bearish?

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Santa Clara, California-based Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. Valued at $280.4 billion by market cap, the company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services.

Shares of this semiconductor giant have outperformed the broader market over the past year. AMD has gained 26.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.1%. In 2025, AMD stock is up 43%, surpassing the SPX’s 8.6% rise on a YTD basis.

Zooming in further, AMD’s outperformance looks more pronounced compared to the iShares Semiconductor ETF (SOXX). The exchange-traded fund has gained about 14% over the past year. Moreover, AMD’s gains on a YTD basis outshine the ETF’s 12.7% returns over the same time frame.

AMD's strong performance can be attributed to record sales of Ryzen and EPYC processors, as well as robust demand in the gaming segment. Revenue exceeded expectations, with significant growth in AI, data center, and GPU segments. The company's roadmap includes expanding its AI data center business, which has the potential for substantial revenue growth. AMD anticipates further growth with the launch of its MI350 GPU line and development of the next-generation MI400 series. Strategic investments in hardware and software capabilities, including recent acquisitions, are strengthening AMD's AI ecosystem. The company's involvement in sovereign AI initiatives worldwide is also contributing to its growth.

On Aug. 5, AMD reported its Q2 results, and its shares closed down more than 6% in the following trading session. Its adjusted EPS of $0.48 exceeded Wall Street's expectations of $0.47. The company’s revenue was $7.7 billion, beating Wall Street forecasts of $7.4 billion. For Q3, AMD expects revenue in the range of $8.4 billion to $9 billion.

For the current fiscal year, ending in December, analysts expect AMD’s EPS to grow 18.3% to $3.10 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

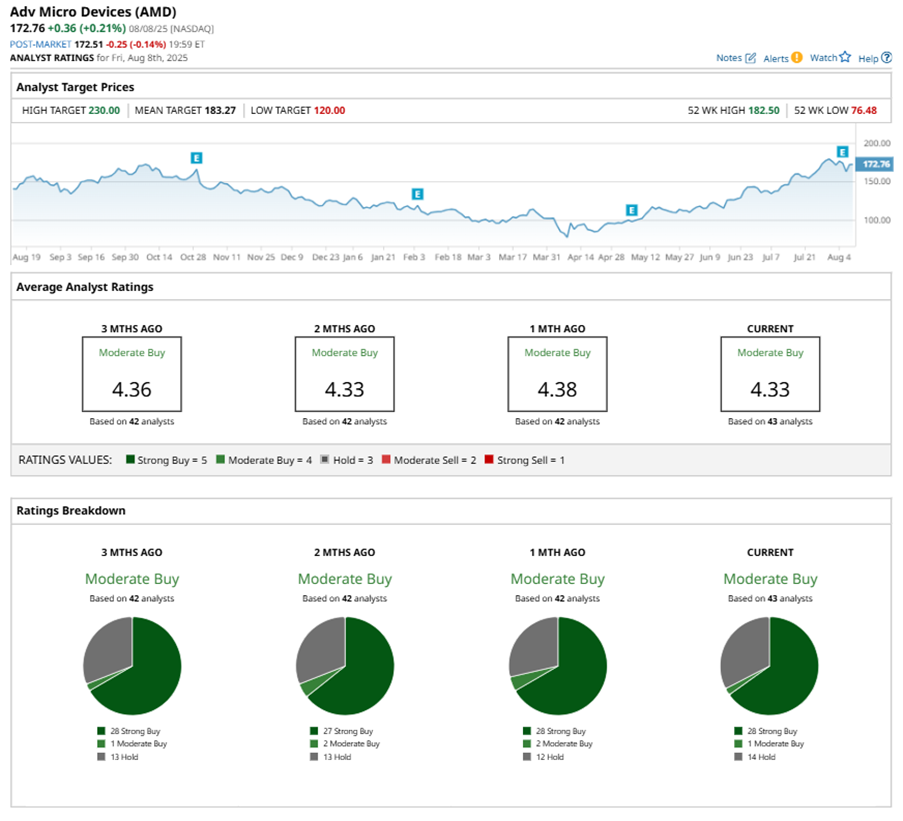

Among the 43 analysts covering AMD stock, the consensus is a “Moderate Buy.” That’s based on 28 “Strong Buy” ratings, one “Moderate Buy,” and 14 “Holds.”

This configuration is less bullish than a month ago, with two analysts suggesting a “Moderate Buy.”

On Aug. 7, DZ Bank upgraded AMD to a “Hold” rating with a $165 price target.

The mean price target of $183.27 represents a 6.1% premium to AMD’s current price levels. The Street-high price target of $230 suggests an upside potential of 33.1%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.