Are Wall Street Analysts Bullish on NVIDIA Stock?

/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)

Santa Clara, California-based NVIDIA Corporation (NVDA) is a key innovator of computer graphics and AI technology. The company provides graphics and compute and networking solutions. With a market cap of $4.5 trillion, NVDA develops a platform for scientific computing, AI, data science, autonomous vehicles, robotics, metaverse, and 3D internet applications, as well as focuses on PC graphics by serving clients worldwide.

Shares of this chip giant have considerably outperformed the broader market over the past year. NVDA has gained 74.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.1%. In 2025, NVDA stock is up 36.1%, surpassing the SPX’s 8.6% rise on a YTD basis.

Zooming in further, NVDA’s outperformance looks more pronounced compared to the iShares Semiconductor ETF (SOXX). The exchange-traded fund has gained about 14% over the past year. Moreover, NVDA’s gains on a YTD basis outshine the ETF’s 12.7% returns over the same time frame.

NVIDIA's Data Center business is driving its impressive growth, fueled by the high demand for AI. The company's Hopper 200 and Blackwell GPU platforms are being widely adopted by cloud and enterprise customers, particularly hyperscalers, to support their AI workloads. With the upcoming Blackwell Ultra and Vera Rubin platforms, NVIDIA is expected to further solidify its position in the AI computing market.

NVDA reported its Q1 results on May 28, and its shares closed up by 3.3% in the following trading session. Its adjusted EPS of $0.81 fell short of Wall Street's expectations of $0.85. The company’s revenue was $44.1 billion, beating Wall Street forecasts of $42.9 billion.

For the current fiscal year, ending in January 2026, analysts expect NVDA’s EPS to grow 37.2% to $4.02 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

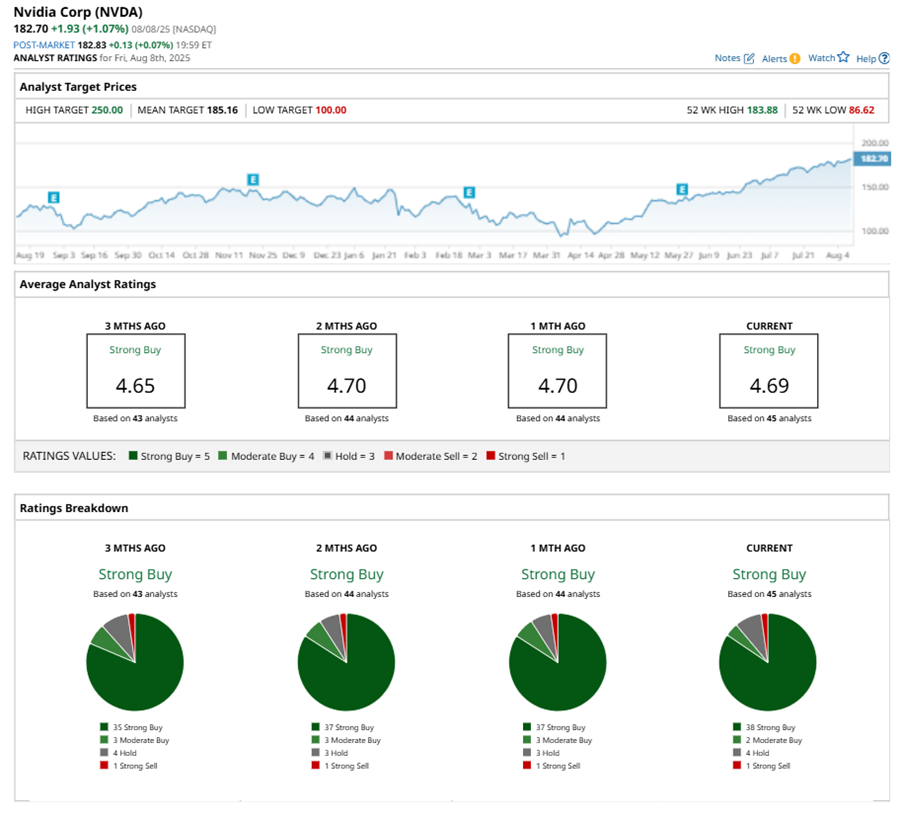

Among the 45 analysts covering NVDA stock, the consensus is a “Strong Buy.” That’s based on 38 “Strong Buy” ratings, two “Moderate Buys,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with 37 analysts suggesting a “Strong Buy,” and three recommending a “Moderate Buy.”

On Aug. 7, The Goldman Sachs Group, Inc. (GS) analyst James Schneider reiterated a “Buy” rating on NVDA and set a price target of $200, implying a potential upside of 9.5% from current levels.

The mean price target of $185.16 represents a 1.3% premium to NVDA’s current price levels. The Street-high price target of $250 suggests an ambitious upside potential of 36.8%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.