Options Traders Price in Volatile Nvidia Earnings Reaction After U.S. Government Deal on AI Chips

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

Semiconductor giants Nvidia (NVDA) and Advanced Micro Devices (AMD) are in focus this morning, thanks to reports of a unique arrangement requiring 15% of China-related artificial intelligence (AI) chip revenue to be paid to the U.S. government. In exchange, the companies will receive export licenses to sell the Nvidia H20 and AMD MI308 in China, respectively, granting them access to a key market for their AI chips.

As investors weigh the unusual deal, anonymously confirmed by a government official to the AP, both NVDA and AMD are volatile on heavy trading volume to start this Monday. Both stocks were down about 0.9% each in the early minutes, and are now trading green. In 2025 so far, AMD has gained 39%, while NVDA is up 31% - easily outperforming the broader equities market.

The Chinese market represents approximately 13% of Nvidia's total sales and a significant portion of AMD's revenue. Alongside U.S.-China trade tensions, Nvidia is also battling state media claims about security risks in its H20 chips.

AMD has shown remarkable resilience with record Q2 revenue of $7.7 billion, representing a 32% year-over-year increase, despite an $800 million inventory charge related to China export restrictions.

What’s Next for the AI Chip Market?

The broader AI semiconductor sector remains strong, with global foundry giant Taiwan Semiconductor (TSM) projecting 30% revenue growth in 2025, supported by major tech companies' aggressive capital expenditure plans in data center expansion. The AI GPU market shows no signs of slowing, with market projections reaching $352.5 billion by 2030.

Nvidia continues to benefit from widespread adoption of its Hopper 200 and Blackwell GPU platforms, while AMD's strategic focus on AI through products like the MI350 GPU series and upcoming MI400 platform positions them as a strong second player in the market.

Wall Street maintains an overwhelmingly bullish stance on NVDA stock, with 38 out of 45 analysts rating it a "Strong Buy," while AMD holds a "Moderate Buy" consensus with a mean price target of $183.27 - about 6% higher than current prices.

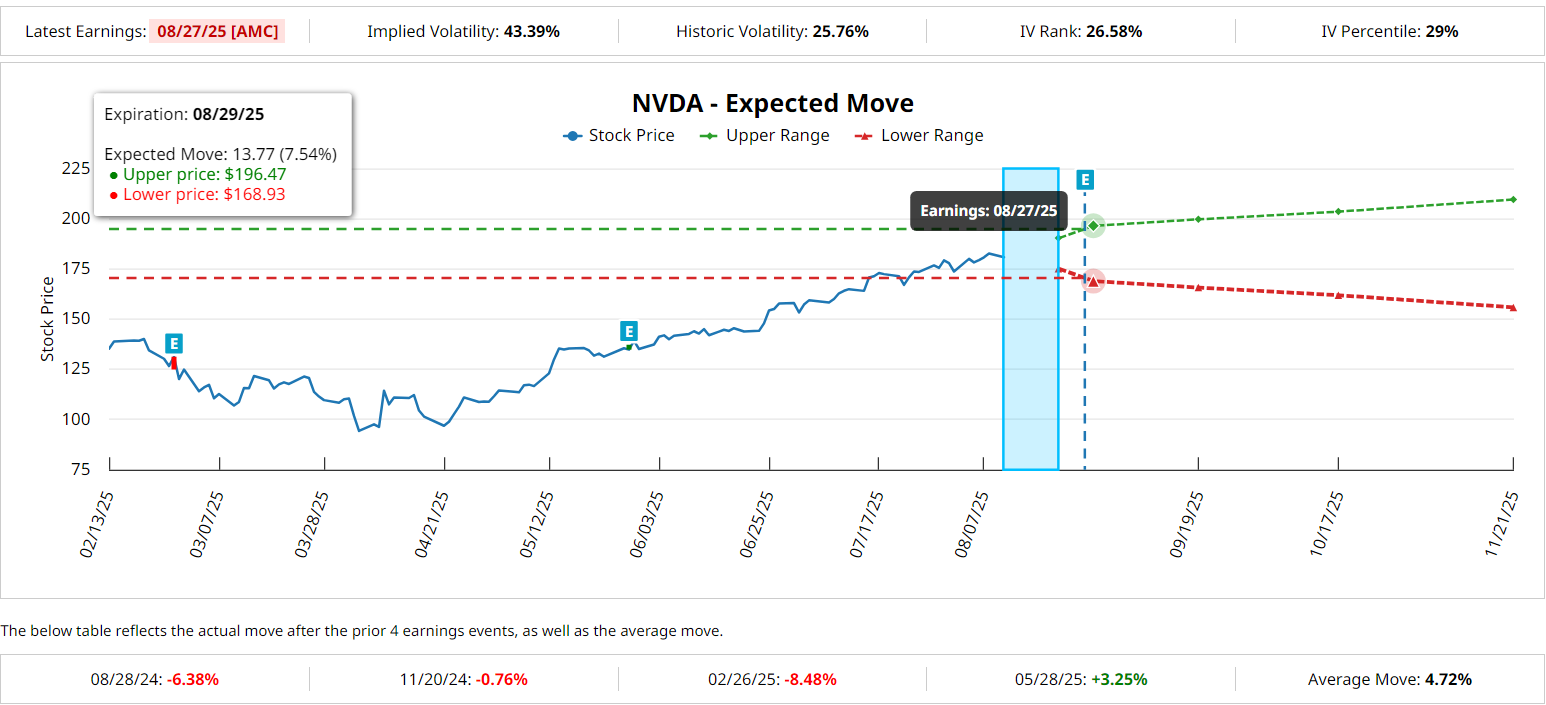

Looking ahead, the next big catalyst for the duo could be Nvidia’s quarterly earnings report, due out after the close on Aug. 27. As of today, options traders are pricing in a bigger-than-usual 7.54% price swing for NVDA after the report.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Elizabeth H. Volk had a position in: AMD , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.