Is Wall Street Bullish or Bearish on First Solar Stock?

/First%20Solar%20Inc%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $19.8 billion, First Solar, Inc. (FSLR) is a leading global provider of photovoltaic (PV) solar energy solutions. The company specializes in manufacturing cadmium telluride thin-film solar modules and offers project development, operations, and maintenance services to utilities, developers, and commercial customers worldwide.

Shares of the Tempe, Arizona-based company have underperformed the broader market over the past 52 weeks. FSLR stock has declined 12.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 20.1%. Moreover, shares of First Solar have risen 4.8% on a YTD basis, compared to SPX's 8.6% increase.

Looking closer, the largest U.S. solar company stock has also fallen behind the Technology Select Sector SPDR Fund's (XLK) 29.3% return over the past 52 weeks.

Shares of First Solar climbed 5.3% following its Q2 2025 results on Jul. 31. The company reported net income of $3.18 per share and revenue of $1.1 billion, topping forecasts. The company also raised its full-year net sales guidance to $4.9 billion - $5.7 billion, above the analyst average, citing expectations for higher product prices following new U.S. tariffs on foreign-made panels.

For the fiscal year ending in December 2025, analysts expect FSLR's EPS to grow 27.3% year-over-year to $15.30. The company's earnings surprise history is mixed. It beat the consensus estimates in one of the last four quarters while missing on three other occasions.

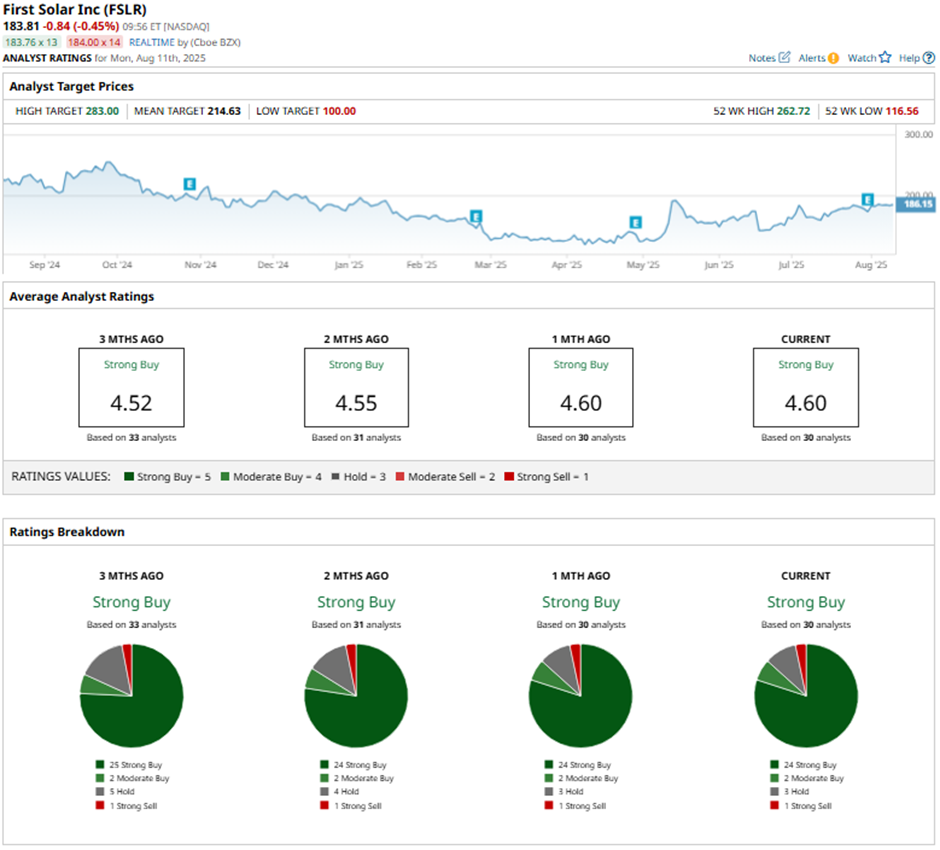

Among the 30 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 24 “Strong Buys,” two “Moderate Buy” ratings, three “Holds,” and one “Strong Sell.”

This configuration is slightly less bullish than three months ago, with 25 “Strong Buy” ratings on the stock.

On Aug. 5, UBS raised First Solar’s price target to $275 with a “Buy" rating.

As of writing, the stock is trading below the mean price target of $214.63. The Street-high price target of $283 implies a potential upside of nearly 54% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.