Are Wall Street Analysts Predicting Zoetis Stock Will Climb or Sink?

/Zoetis%20Inc%20HQ%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $65.3 billion, Zoetis Inc. (ZTS) is a global leader in animal health, specializing in medicines, vaccines, diagnostics, and precision health solutions for both livestock and companion animals. The company serves veterinarians, livestock producers, and pet owners worldwide, with a diversified portfolio spanning vaccines, parasiticides, dermatology, anti-infectives, and advanced diagnostic services.

Shares of the Parsippany, New Jersey-based company have underperformed the broader market over the past 52 weeks. ZTS stock has decreased 19.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 19.6%. Moreover, Zoetis stock has dropped 8.6% on a YTD basis, compared to SPX's 8.7% rise.

Looking closer, shares of the animal health company have also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 12.8% dip over the past 52 weeks.

Despite posting better-than-expected Q2 2025 adjusted EPS of $1.76 and revenue of $2.5 billion, Zoetis shares fell 3.8% on Aug. 5 due to weakness in certain product lines. U.S. sales of monoclonal antibody OA pain treatments Librela and Solensia declined, likely on fears of side effects in some dogs, partially offsetting the 9% growth in companion animal sales. Additionally, U.S. livestock product sales plunged 21% to $180 million.

For the fiscal year ending in December 2025, analysts expect ZTS’s adjusted EPS to grow 7.4% year-over-year to $6.36. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

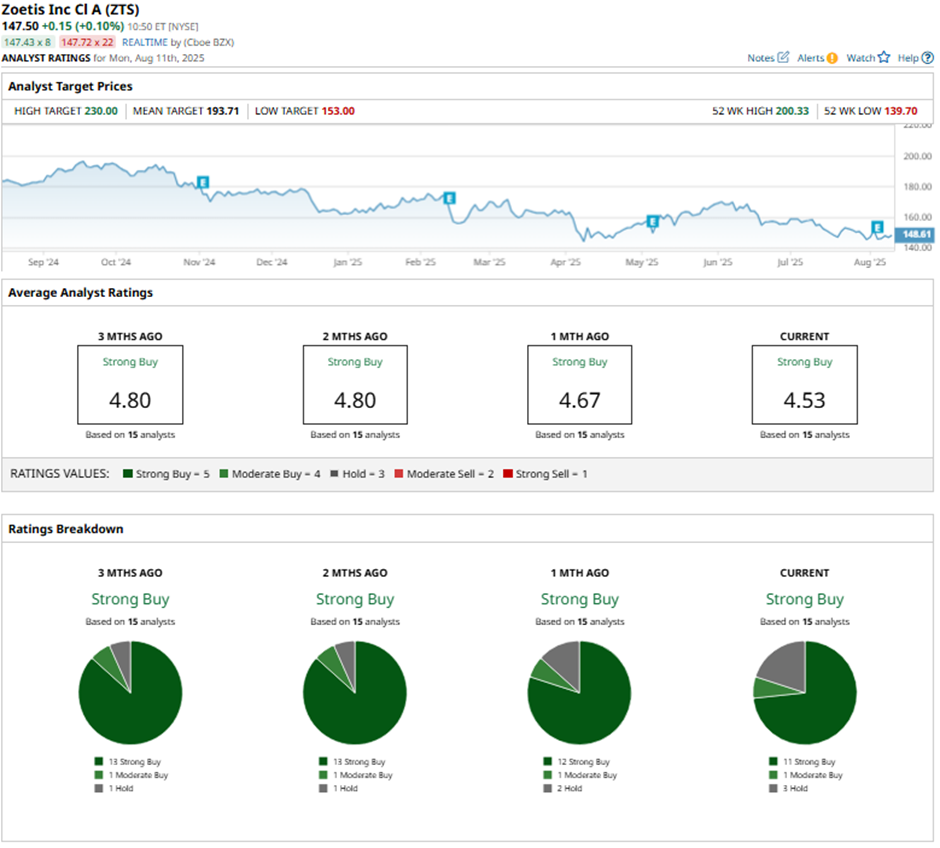

Among the 15 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and three “Holds.”

This configuration is less bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Aug. 7, UBS analyst Andrea Alfonso reaffirmed a “Hold” rating on Zoetis and set a price target of $165.

As of writing, the stock is trading below the mean price target of $193.71. The Street-high price target of $230 implies a modest potential upside of 55.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.