Broadcom Hits New High: Is AVGO Stock Still a Buy?

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) stock has been on a tear, recently hitting a new all-time high of $310.34 on Aug. 7. The semiconductor and infrastructure software giant has delivered an impressive 107% gain over the past year, with nearly half of that surge occurring in just the past three months. These rapid gains have been primarily driven by explosive growth in its artificial intelligence (AI) semiconductor business. Moreover, the momentum in that business is showing no signs of slowing down.

AI-Driven Demand Accelerates Broadcom’s Growth

Broadcom’s latest earnings highlight just how strong this momentum has become. In its fiscal second quarter, Broadcom posted $8.4 billion in semiconductor revenue, marking a 17% year-over-year increase. This reflects acceleration from the 11% growth it reported in Q1. The biggest driver was AI-related sales, which brought in more than $4.4 billion, up an impressive 46% from last year. Q2 marked AVGO’s ninth consecutive quarter of double-digit AI revenue growth, a streak that reflects the company’s ability to capture market share in one of the fastest-growing segments.

Within its AI business, custom AI accelerators grew at a solid double-digit pace, while AI networking revenue soared more than 170% year-over-year. AI networking, built on Ethernet technology, has been particularly strong, accounting for 40% of Broadcom’s AI sales. Ethernet is popular because it works well for both small and large systems, making it the go-to choice for Broadcom’s hyperscale customers. The company’s robust networking portfolio, which includes its Tomahawk switches, Jericho routers, and network interface cards (NICs), is a key part of building AI systems in large cloud data centers and will support future growth.

Broadcom’s Growth Outlook Remains Solid

Broadcom’s growth shows no signs of slowing down, with strong performance across both its AI semiconductor and infrastructure software businesses setting the stage for continued momentum. The company’s management expects AI semiconductor revenue to reach $5.1 billion in the third quarter, a solid 60% increase from the same period last year. This would mark a sequential acceleration in growth rate, signifying solid demand trends.

One of the key drivers behind this surge is Broadcom’s custom AI accelerators, known as XPUs. These chips are in high demand as major technology players scale up their AI infrastructure. Broadcom is currently working with three existing customers focused on large-scale AI deployments that depend on tailor-made XPUs. The company expects this demand to intensify, particularly as inference workloads grow rapidly. Management anticipates a notable ramp-up in XPU demand in the second half of 2026, which could further accelerate its growth rate.

Broadcom’s infrastructure software segment continues to deliver solid results, thanks in large part to the integration of VMware. In the second quarter, this business marked 25% year-over-year growth, generating $6.6 billion in revenue. A key growth lever here has been the shift from traditional perpetual licenses for VMware’s vSphere to the subscription-based VMware Cloud Foundation (VCF) platform. This transition has been driving steady double-digit gains in annual recurring revenue, reflecting the stickiness of Broadcom’s software model.

Looking ahead, management is confident this momentum will continue. For the third quarter, Broadcom is guiding for infrastructure software revenue of around $6.7 billion, representing a projected 16% increase from a year ago.

In summary, with solid demand in both AI hardware and subscription-based software, Broadcom’s outlook remains strong, supporting its share price.

Here’s What Broadcom Stock’s Valuation Indicates

Of course, with such rapid growth, valuations have climbed as well. AVGO is currently trading at a forward price-earnings (P/E) ratio of 55.46x. That might seem steep, but Wall Street sees earnings growth, which justifies it. Analysts expect Broadcom’s earnings per share to jump 47.7% in fiscal 2025, followed by a still-strong 28.7% growth rate in 2026.

From a technical perspective, Broadcom’s rally has room to run. The stock’s 14-day Relative Strength Index (RSI) is sitting at 65.51, below the overbought level of 70, suggesting there’s still potential upside if upcoming results impress.

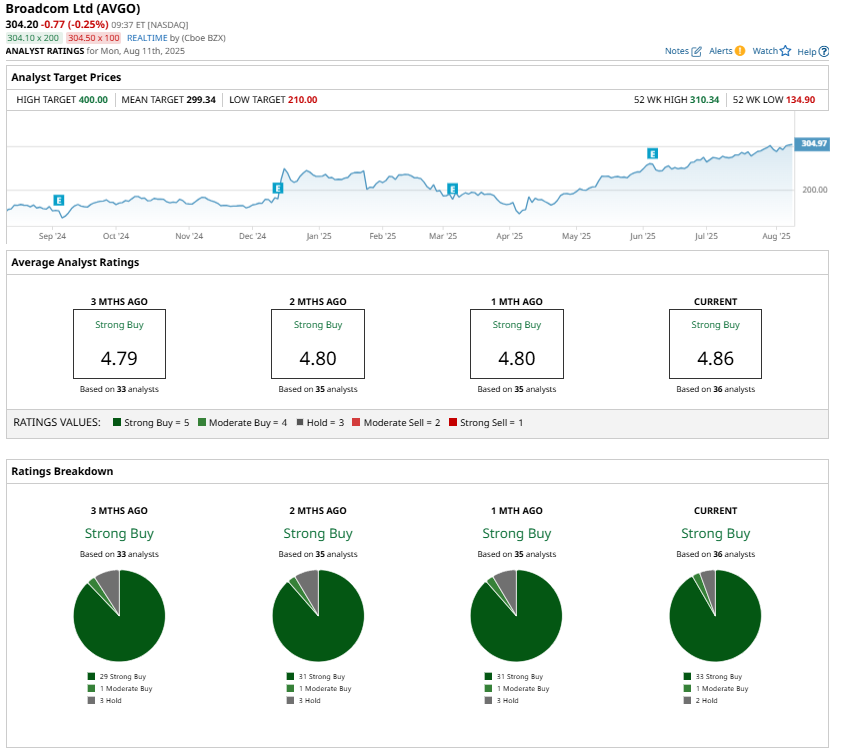

Analysts Are Bullish on Broadcom Stock

Wall Street remains bullish on Broadcom. Analysts maintain a “Strong Buy” consensus, pointing to the expected demand for its Tomahawk 6 switch and custom AI accelerators as key drivers of future gains. The highest price target on the Street stands at $400, suggesting potential 30% upside from current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.