Shopify's Higher FCF Margins Can Push SHOP Stock Higher

/The%20Shopify%20logo%20on%20a%20smartphone%20screen%20by%20IB%20Photography%20%20via%20Shutterstock.jpg)

Shopify, Inc. (SHOP) achieved a 15.75% quarterly free cash flow margin, surpassing its Q1 margin of 15.38% on higher revenue. This could push SHOP stock +14.6% higher as analysts incorporate higher margins into their forecasts.

SHOP is trading at $149.70 in midday trading on Monday, August 11. Based on our assessment, SHOP could be worth $224 billion in market value, compared to its current market cap of $194.8 billion (Yahoo! Finance).

That represents a +14.6% upside in SHOP's value, or a price target of $171.55 per share. That's over 12% higher than the prior price target of $136.66 in my July 16 Barchart article ("Shopify Stock is a Bargain - How to Make a 3% One-Month Yield with SHOP").

Shopify's Strong Free Cash Flow and FCF Margins

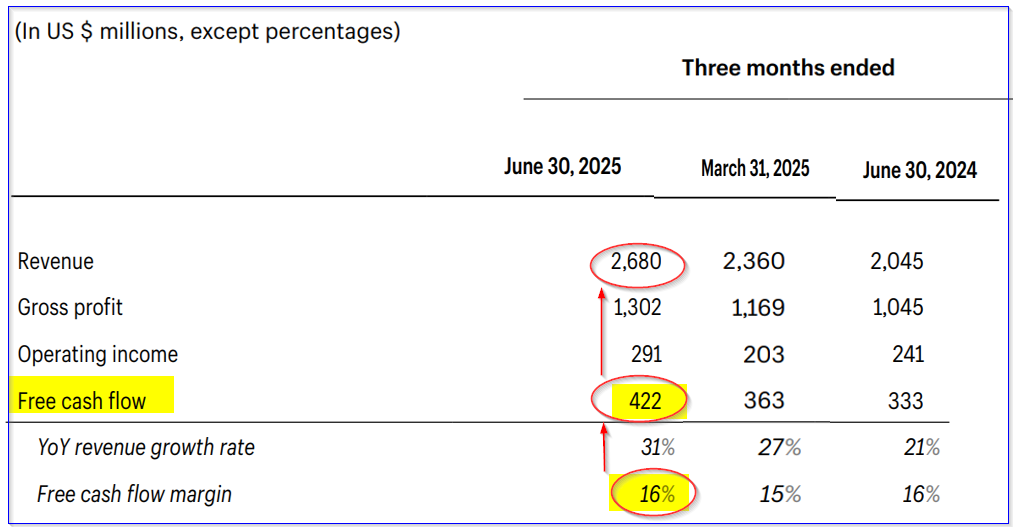

Shopify reported $422 million in free cash flow (FCF) for Q2 on Aug. 6. That was +26.7% higher than last year's $333 million and +16.3% higher than the $363 million in Q1.

However, this was also a very high percentage of sales, despite the latter rising +31% Y/Y. This can be seen in the company's Q2 and Q1 tables below.

The point is that FCF was 15.75% of revenue, on par with last year's 16.3% and higher than the 15.37% FCF margin in Q1.

However, over the trailing 12 months (TTM) ending June 30, the FCF margin was even higher at 18.14% (i.e., $1.817 billion on $10.014 billion in TTM sales). That was even higher than the 18.0% FCF margin in 2024. This data can be seen in Stock Analysis's TTM Cash Flow data.

The point is that Shopify is squeezing out ever higher portions of its revenue even as sales increase very strongly. For example, management said in its Outlook section on page 2 of the Q2 earnings release that it expects Q3 FCF margins to be in the mid to high teens in Q3. That implies its Q3 margins could rise to 18% or higher.

We can use that to project its next 12-month (NTM) FCF and then set a price target.

Forecasting Shopify's FCF

For example, analysts now forecast that 2025 sales will be $11.25 billion. That is higher than the $10.88 billion forecast quoted in my July 13 Barchart using the same source, Seeking Alpha. So, using an 18% FCF margin estimate for 2025:

$11.25 billion 2025 revenue x 0.18 = $2.025 billion FCF 2025

And for 2026, using analysts' $13.66 billion sales estimates:

$13.55 billion 2026 revenue x 18% = $2.439 billion FCF 2026

As a result, the average NTM FCF estimate is $2.232 billion. That is almost 12% higher than the $1.817 billion in TTM FCF. As a result, Shopify's valuation could likely rise. Let's see why.

Price Target for SHOP Stock

Shopify does not pay a dividend. But, if it were to do so, the payments would come out of the free cash flow the company generates. Let's assume that it pays out 50% of its FCF over the coming 12 months. What would the dividend yield be? That will allow us to value SHOP stock.

For example, the market already values Shopify stock at less than a 1.0% FCF yield. This can be seen by dividing the $1.8 billion in TTM FCF by its present market cap of $194.8 billion.

$1.817b / $194.8b = 0.0093 = 0.93% yield

Therefore, if we assume that its future FCF is valued at 1.0% of its present market cap, here is what that means:

$2.232 billion / 0.01 = $223.2 billion market cap

For example, if it paid out $1.116 billion and the market gave the stock a 0.5% dividend yield, its implied market cap is:

$1.116b / 0.005 = $223.2 billion market cap

That market cap is +14.6% higher than today's market cap of $194.8 billion. That means that SHOP stock is worth +14.6% more:

$149.70 x 1.146 = $171.55 per share

How to Play This Shorting OTM Puts

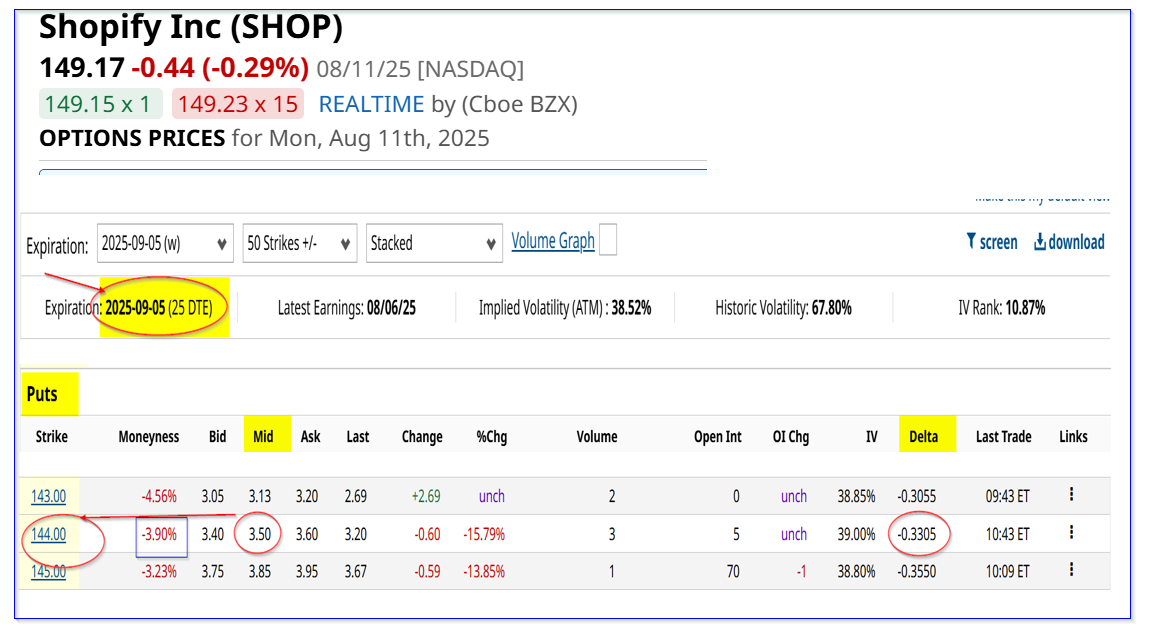

One way to play this is to sell short out-of-the-money (OTM) puts in nearby expiry periods. I discussed this in my July 13 Barchart article.

For example, I suggested shorting the Aug. 15 $100 put strike price for a midpoint price of $3.28 per put contract. That provided an immediate 3.28% yield on investment for the short seller.

There is every indication that this put will expire worthless on Friday, as it is trading today for just 2 cents, so the trade will be successful.

This high-yield short-put play can now be repeated to set a lower potential buy-in point for an investor in SHOP stock.

For example, the Sept. 5 put expiry period shows that the $144.00 strike price, 4% below today's trading price, has a midpoint premium of $3.50. That provides an immediate yield of 2.43% (i.e., $3.50/$144.00).

This allows a new potential investor in SHOP stock to set a lower buy-in point. For existing investors, it provides additional income and a way to potentially reduce their average cost.

For example, to do this trade, an investor first secures $14,400 in cash and/or buying power with their brokerage firm. That acts as collateral to potentially buy 100 shares at $144.00 in case the account is assigned to buy those shares if SHOP falls to $144.00 on or before Sept. 5.

But, in return, the account also immediately receives $350.00. So the investor has made an immediate yield of $350/$14,400, or 2.43% on the collateral posted. If SHOP does not fall to $144.00, the investor's account still keeps that income.

As a result, the net potential breakeven point, even if SHOP falls to $144.00, is just $140.50. That is 5.8% below the trading price today. So, this is a way to set a lower buy-in point with good downside protection.

The bottom line is that SHOP stock looks undervalued here, given its huge FCF margins. One way to profitably play this is to short out-of-the-money (OTM) puts in nearby expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.