My Favorite Options Trade Lets You Say ‘YOLO’ with Bitcoin Without Betting the House

I have repeatedly described the current market climate as the most dangerous and most opportunistic I’ve seen in my career, which dates back to the 1980s. What do we do with that?

We go for high returns, but define upfront how much we can lose if the asset we’re buying takes a dive and doesn’t recover any time soon.

With that broad concept in mind, I came to Bitcoin (BTCUSD). But not just any Bitcoin investment. A leveraged one, specifically the Volatility 2X Bitcoin Strategy ETF (BITX), a 2x levered exchange-traded fund (ETF) that tracks Bitcoin’s price trend.

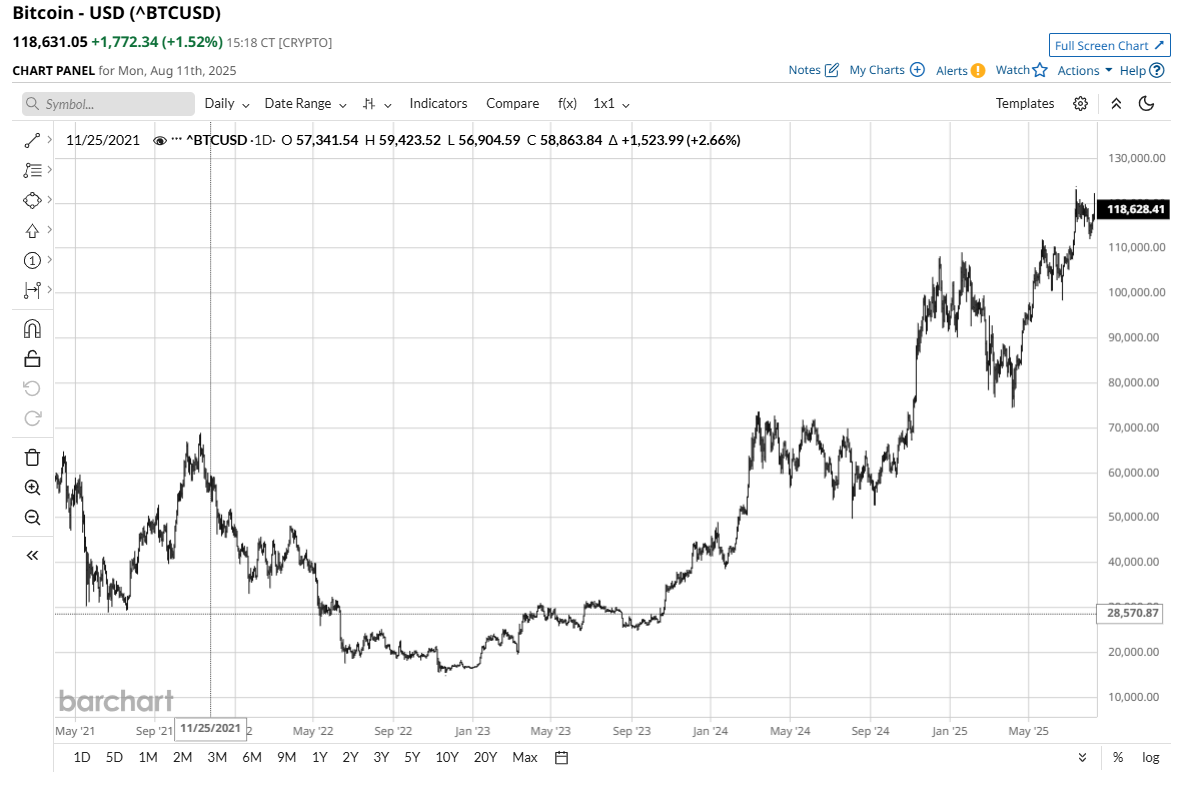

I’d say this ETF is not for the faint of heart, since we have seen Bitcoin’s spot price fall from $63,000 to $33,000 in just 2 months back during the spring of 2021. And from $67,000 to $16,000 in about 12 months, from late 2021 through late 2022.

Bitcoin – and broader cryptocurrency – adoption have accelerated since that time. But I do sense that some of that continues to be a “number go up” situation. That is, many traders buy Bitcoin because it is going up and have heard the hype that cryptocurrency is a secular theme that will continue to take hold.

I’m not here to throw cold water on any of that. I’m just here to manage risk.

And increasingly, I find that this market, being both historically dangerous and opportunistic, draws me to assets I would not otherwise embrace for my trading. Like Bitcoin. And particularly, an ETF that offers double the upside, and twice the downside.

Note that as with most leveraged ETFs, the math of investment loss is in play here. That means that if you lose, say 10%, you need to make about 11% to get back to where you started. These vehicles are geared to essentially be daily trading assets. However, I have found that in most cases, other than in extreme downside moves, they can sometimes be held for several days, weeks, or even months.

The appeal here is that if we collar it, we get most of the upside and cap our downside where we want to, for a set period of time. Let’s look at the history, the current chart, and some collar possibilities.

That chart above says a lot about BITX from a reward and risk perspective. During the 2-year timeframe shown for that ETF, it has been cut in half and then doubled since late December. A similar roller coaster ride occurred during 2024.

That round-trip indicates to me that BITX and crypto in general are very much in sync with the broad stock market and investor appetite for risk. So collaring it makes sense to consider here, as a supplement or alternative to trading around it. And since 100 shares is needed to buy 1 put and sell 1 call contract, that’s a $6,500 investment in the underlying ETF.

The chart indicates to me that BITX, while threatening to break out to a new high level about 10% north of here, can also correct sharply at any time. So let’s see if we can get most of the good stuff, while defining the worst-case up front. I’ll note that with this ETF, the options liquidity is far less than the unleveraged versions. So I’m only going out about 5 weeks to Sept. 19 in this example. Also, note that the Barchart IV Rank is under 3%, which means that BITX’s volatility is nearly at a 12-month low.

This means that the puts are relatively cheap, but so too are the calls. Translation: I can hedge this at the money essentially ($64 put strike price) and get a ton of upside ($85 call strike price) to get more than 30% of any near-term Bitcoin price appreciation. But the puts will cost much more than the calls bring back. To show how the tradeoffs work here, below is a set of option collar pairings, with the put strike and expiration date held constant at $64 and 9/19/25, respectively.

But the call strikes are shown at multiple lower levels. That results in a lower out of pocket cost for the trade, but less upside on BITX.

Like I said, I’m not a Bitcoin bull, or bear. I simply see it as a volatile asset I’d like to piggy back on as a trader, with a modest portion of my portfolio. Collaring it is one way to clamp down on the downside, while still “YOLO-ing” along with crypto fans.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.