Are Wall Street Analysts Predicting Linde Stock Will Climb or Sink?

With a market cap of $220.6 billion, Linde plc (LIN) is a leading global industrial gases and engineering company serving diverse industries such as healthcare, chemicals & energy, manufacturing, and electronics. The company supplies atmospheric and process gases worldwide and designs and builds advanced process plants for both its operations and third-party clients.

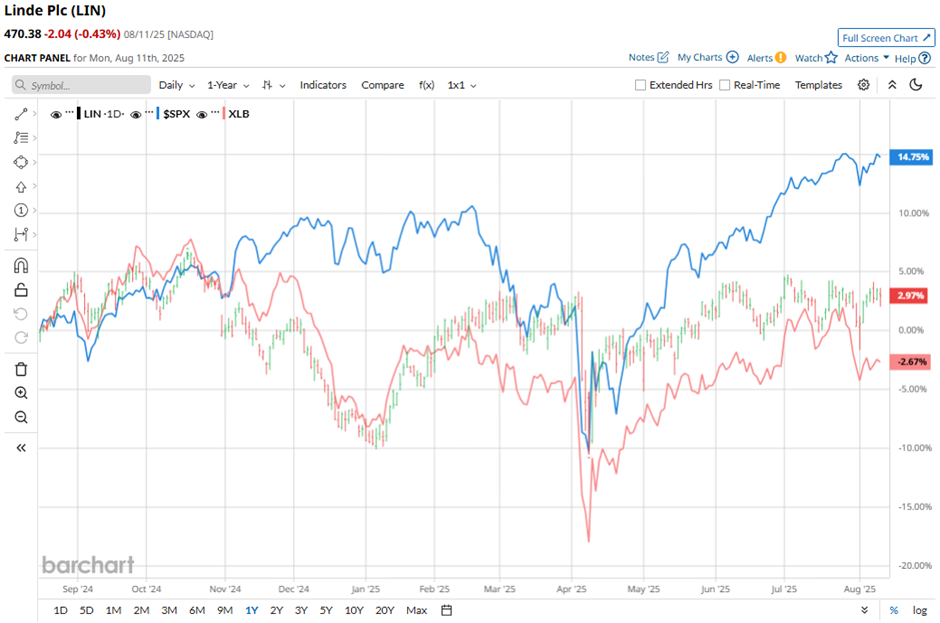

Shares of the Woking, the United Kingdom-based company have underperformed the broader market over the past 52 weeks. LIN stock has risen 5.2% over this time frame, while the broader S&P 500 Index ($SPX) has increased 19.3%. However, shares of the company have gained 12.4% on a YTD basis, outperforming SPX's 8.4% return.

Looking closer, LIN stock has outpaced the Materials Select Sector SPDR Fund's (XLB) marginal decline over the past 52 weeks.

Despite Linde’s better-than-expected Q2 2025 adjusted EPS of $4.09 and revenues of $8.5 billion, shares fell marginally on Aug. 1. The Engineering segment’s operating profit fell to $90 million, missing the estimate, and the EMEA segment saw lower volumes in key end markets like metals & mining and manufacturing despite higher pricing.

For the fiscal year ending in December 2025, analysts expect LIN's EPS to grow 6% year-over-year to $16.44. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

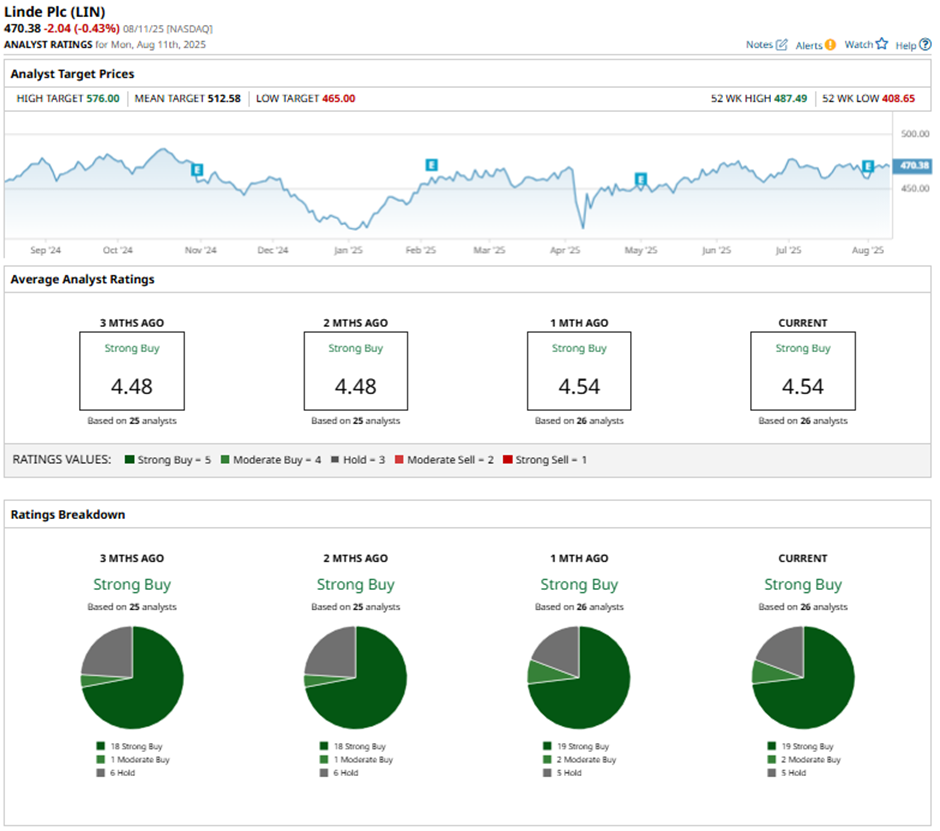

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

This configuration is slightly more bullish than three months ago, with 18 “Strong Buy” ratings on the stock.

On Aug. 4, JPMorgan analyst Jeffrey Zekauskas raised Linde’s price target to $475, maintaining an “Overweight" rating.

As of writing, the stock is trading below the mean price target of $512.58. The Street-high price target of $576 implies a modest potential upside of 22.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.