What Are Wall Street Analysts' Target Price for UnitedHealth Stock?

/Unitedhealth%20Group%20Inc%20%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

UnitedHealth Group Incorporated (UNH), headquartered in Minnetonka, Minnesota, owns and manages organized health systems. With a market cap of $228.9 billion, the company provides employers products and resources to plan and administer employee benefit programs, serving customers worldwide.

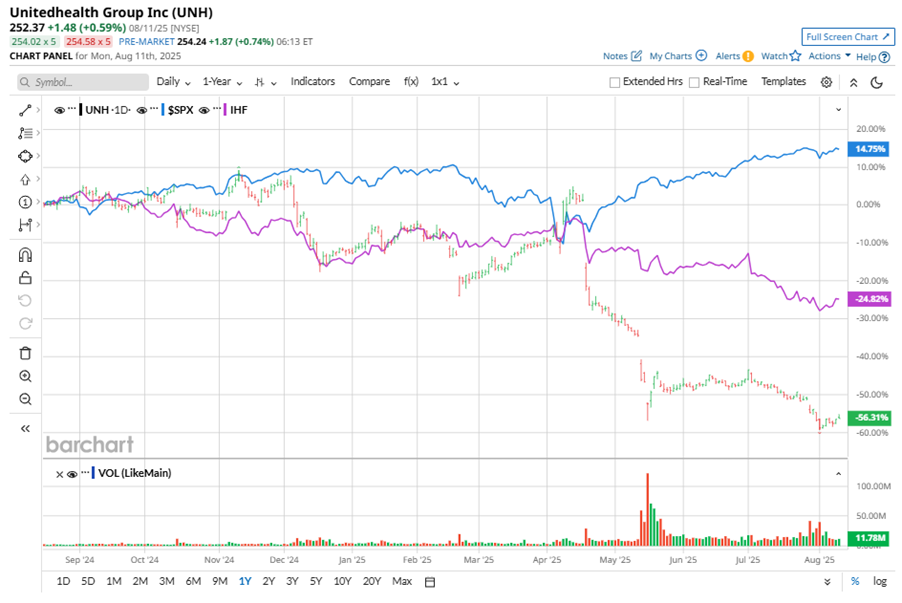

Shares of this health insurance giant have significantly underperformed the broader market over the past year. UNH has declined 54.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19.3%. In 2025, UNH’s stock fell 50.1%, compared to the SPX’s 8.4% rise on a YTD basis.

Narrowing the focus, UNH’s underperformance is also apparent compared to the iShares U.S. Healthcare Providers ETF (IHF). The exchange-traded fund has declined about 22.9% over the past year. Moreover, the ETF’s 11.3% losses on a YTD basis outshine the stock’s dip over the same time frame.

UNH's underperformance stems from DOJ investigations into its Medicare billing practices, which have added to recent challenges, including CEO Andrew Witty's abrupt departure and suspended earnings guidance due to rising medical costs.

On Jul. 29, UNH reported its Q2 results, and its shares closed down by 7.5% in the following trading session. Its adjusted EPS of $4.08 fell short of Wall Street's expectations of $4.84. The company’s revenue was $111.62 billion, exceeding Wall Street forecasts of $111.55 billion. UNH expects full-year adjusted EPS to be $16, and expects revenue in the range of $344 billion to $345.5 billion.

For the current fiscal year, ending in December, analysts expect UNH’s EPS to decline 41.5% to $16.19 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

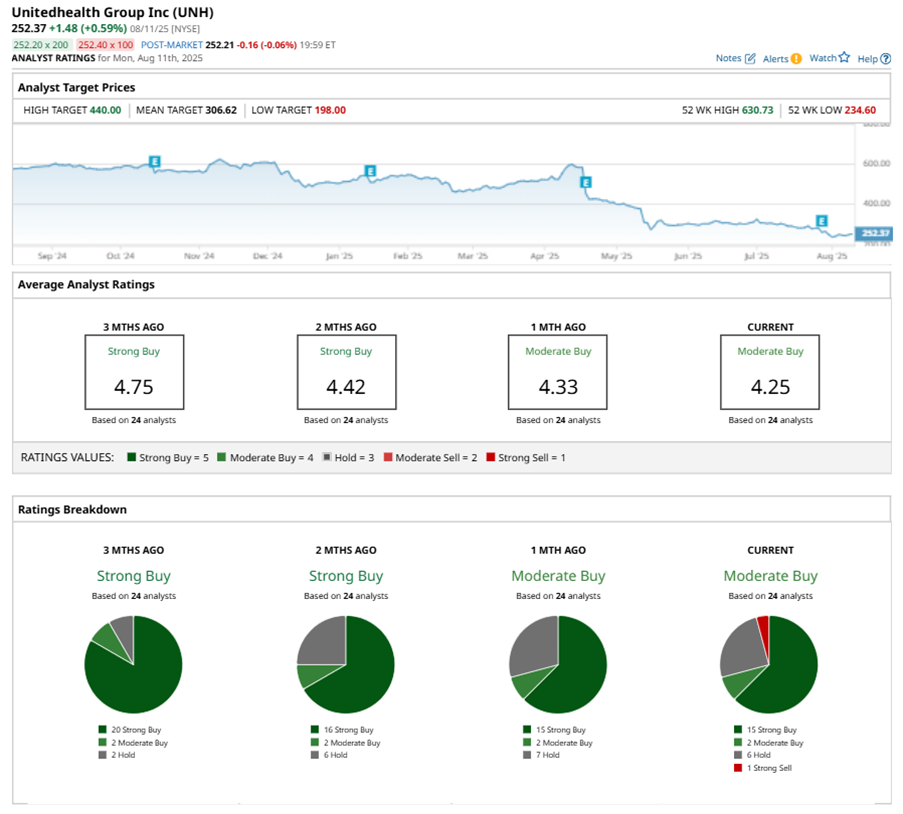

Among the 24 analysts covering UNH stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, two “Moderate Buys,” six “Holds,” and one “Strong Sell.”

This configuration is less bullish than two months ago, with its overall “Strong Buy” rating, consisting of 16 analysts suggesting a “Strong Buy.”

On Aug. 5, Piper Sandler Companies (PIPR) analyst Jessica Tassan reiterated a “Buy” rating on UNH and set a price target of $280, implying a potential upside of 10.9% from current levels.

The mean price target of $306.62 represents a 21.5% premium to UNH’s current price levels. The Street-high price target of $440 suggests an ambitious upside potential of 74.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.