Are Wall Street Analysts Predicting Analog Devices Stock Will Climb or Sink?

/Analog%20Devices%20Inc_%20HQ%20photo-by%20Sundry%20Photography%20via%20iStock.jpg)

With a market cap of $115.1 billion, Analog Devices, Inc. (ADI) designs, manufactures, and markets analog, mixed-signal, and digital signal processing ICs, software, and subsystems. Its products include data converters, amplifiers, power management ICs, MEMS sensors, RF/microwave components, and DSPs for industrial, automotive, consumer, communications, aerospace, defense, and healthcare markets worldwide.

Shares of the Wilmington, Massachusetts-based company have underperformed the broader market over the past 52 weeks. ADI stock has risen 9.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 20.6%. Moreover, shares of Analog Devices are up 9.2% on a YTD basis, compared to SPX's 9.6% gain.

In addition, the tech giant's stock has lagged behind the Technology Select Sector SPDR Fund's (XLK) 29.4% return over the past 52 weeks.

Despite beating Q2 2025 expectations with adjusted EPS of $1.85 and revenue of $2.6 billion, ADI shares fell 4.6% on May 22 because its Q3 forecast included a sequential decline in the key automotive segment. The company attributed recent auto sales strength, up 24% in Q2, to tariff-related pull-ins, raising concerns that demand was artificially inflated and not sustainable.

For the fiscal year ending in October 2025, analysts expect ADI's adjusted EPS to grow nearly 16% year-over-year to $7.40. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

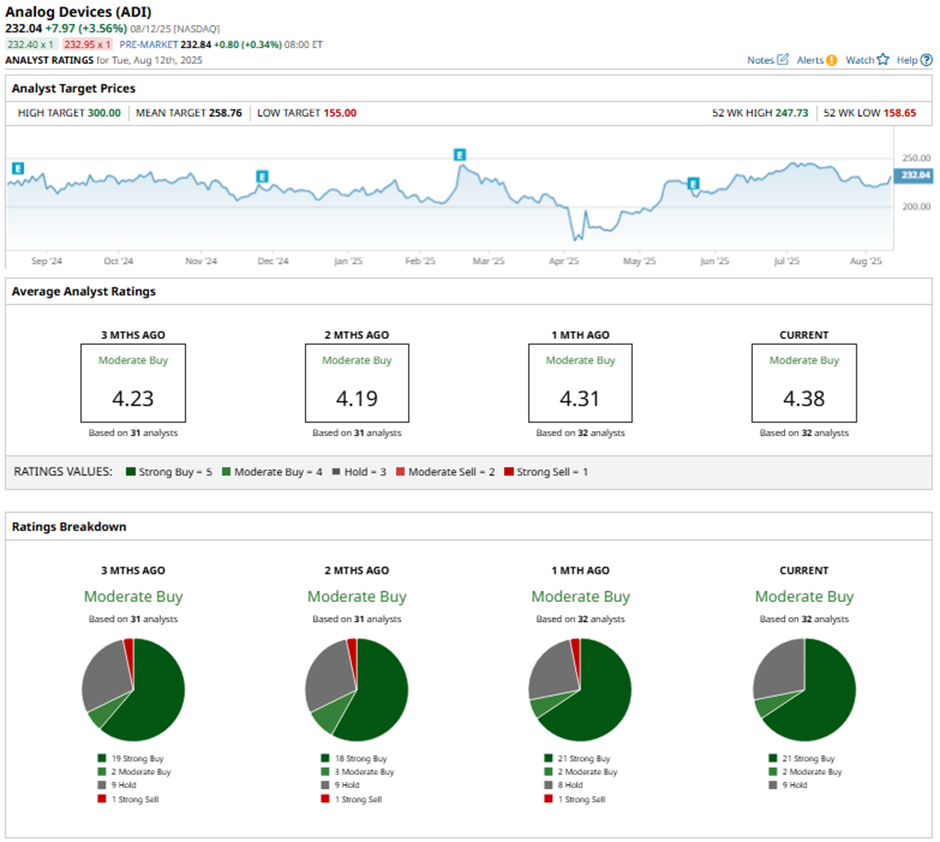

Among the 32 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 21 “Strong Buy” ratings, two “Moderate Buys,” and nine “Holds.”

This configuration is more bullish than three months ago, with 19 “Strong Buy” ratings on the stock.

On Jul. 21, BofA analyst Vivek Arya raised Analog Devices’ price target to $275, maintaining a “Buy" rating.

As of writing, the stock is trading below the mean price target of $258.76. The Street-high price target of $300 implies a potential upside of 29.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.